Form 6230 - Alaska Corporation Application For Quick Refund Of Overpayment Of Estimated Tax - 2015

ADVERTISEMENT

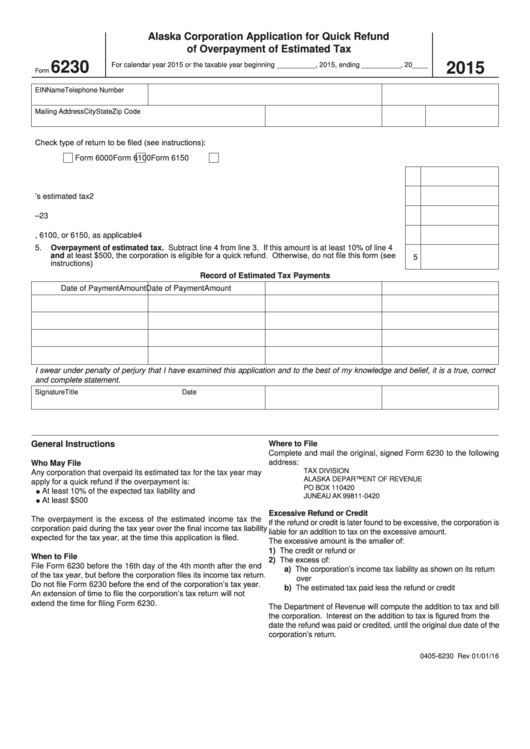

Alaska Corporation Application for Quick Refund

of Overpayment of Estimated Tax

6230

For calendar year 2015 or the taxable year beginning __________, 2015, ending __________, 20____

2015

Form

EIN

Name

Telephone Number

Mailing Address

City

State

Zip Code

Check type of return to be filed (see instructions):

Form 6000

Form 6100

Form 6150

1.

Alaska estimated income tax paid during the tax year

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2.

Overpayment of income tax from prior year credited to this year’s estimated tax

2

.

.

.

.

.

.

.

3.

Total. Add lines 1–2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4.

Enter total tax from line 9 of Form 6000, 6100, or 6150, as applicable

.

.

.

.

.

.

.

.

.

.

.

4

5.

Overpayment of estimated tax. Subtract line 4 from line 3. If this amount is at least 10% of line 4

and at least $500, the corporation is eligible for a quick refund. Otherwise, do not file this form (see

5

instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Record of Estimated Tax Payments

Date of Payment

Amount

Date of Payment

Amount

I swear under penalty of perjury that I have examined this application and to the best of my knowledge and belief, it is a true, correct

and complete statement.

Signature

Title

Date

General Instructions

Where to File

Complete and mail the original, signed Form 6230 to the following

address:

Who May File

TAX DIVISION

Any corporation that overpaid its estimated tax for the tax year may

ALASKA DEPARTMENT OF REVENUE

apply for a quick refund if the overpayment is:

PO BOX 110420

At least 10% of the expected tax liability and

JUNEAU AK 99811-0420

At least $500

Excessive Refund or Credit

The overpayment is the excess of the estimated income tax the

f the refund or credit is later found to be excessive, the corporation is

I

corporation paid during the tax year over the final income tax liability

liable for an addition to tax on the excessive amount.

expected for the tax year, at the time this application is filed.

The excessive amount is the smaller of:

1) The credit or refund or

When to File

2) The excess of:

File Form 6230 before the 16th day of the 4th month after the end

a) The corporation’s income tax liability as shown on its return

of the tax year, but before the corporation files its income tax return.

over

Do not file Form 6230 before the end of the corporation’s tax year.

b) The estimated tax paid less the refund or credit

An extension of time to file the corporation’s tax return will not

extend the time for filing Form 6230.

The Department of Revenue will compute the addition to tax and bill

the corporation. Interest on the addition to tax is figured from the

date the refund was paid or credited, until the original due date of the

corporation’s return.

0405-6230 Rev 01/01/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1