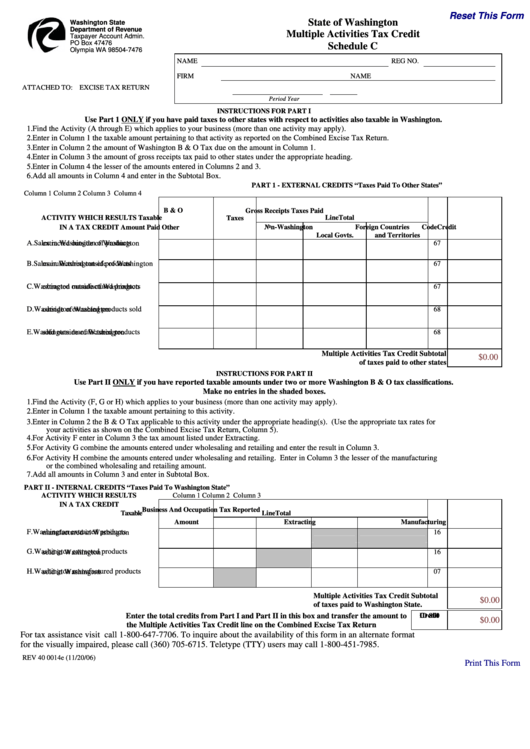

Reset This Form

State of Washington

Washington State

Department of Revenue

Multiple Activities Tax Credit

Taxpayer Account Admin.

PO Box 47476

Schedule C

Olympia WA 98504-7476

NAME

REG NO.

FIRM NAME

ATTACHED TO:

EXCISE TAX RETURN

Period

Year

INSTRUCTIONS FOR PART I

Use Part 1 ONLY if you have paid taxes to other states with respect to activities also taxable in Washington.

1.

Find the Activity (A through E) which applies to your business (more than one activity may apply).

2.

Enter in Column 1 the taxable amount pertaining to that activity as reported on the Combined Excise Tax Return.

3.

Enter in Column 2 the amount of Washington B & O Tax due on the amount in Column 1.

4.

Enter in Column 3 the amount of gross receipts tax paid to other states under the appropriate heading.

5.

Enter in Column 4 the lesser of the amounts entered in Columns 2 and 3.

6.

Add all amounts in Column 4 and enter in the Subtotal Box.

PART 1 - EXTERNAL CREDITS “Taxes Paid To Other States”

Column 1

Column 2

Column 3

Column 4

B & O

Gross Receipts Taxes Paid

ACTIVITY WHICH RESULTS

Taxable

Line

Total

Taxes

IN A TAX CREDIT

Amount

Paid

Other

Non-Washington

Foreign Countries

Code

Credit

U.S. States

Local Govts.

and Territories

A.

Sales in Washington of products

67

extracted outside of Washington

B.

Sales in Washington of products

67

manufactured outside of Washington

C.

Washington manufactured products

67

extracted outside of Washington

D.

Washington extracted products sold

68

outside of Washington

E.

Washington manufactured products

68

sold outside of Washington

Multiple Activities Tax Credit Subtotal

$0.00

of taxes paid to other states

INSTRUCTIONS FOR PART II

Use Part II ONLY if you have reported taxable amounts under two or more Washington B & O tax classifications.

Make no entries in the shaded boxes.

1.

Find the Activity (F, G or H) which applies to your business (more than one activity may apply).

2.

Enter in Column 1 the taxable amount pertaining to this activity.

3.

Enter in Column 2 the B & O Tax applicable to this activity under the appropriate heading(s). (Use the appropriate tax rates for

your activities as shown on the Combined Excise Tax Return, Column 5).

4.

For Activity F enter in Column 3 the tax amount listed under Extracting.

5.

For Activity G combine the amounts entered under wholesaling and retailing and enter the result in Column 3.

6.

For Activity H combine the amounts entered under wholesaling and retailing. Enter in Column 3 the lesser of the manufacturing

or the combined wholesaling and retailing amount.

7.

Add all amounts in Column 3 and enter in Subtotal Box.

PART II - INTERNAL CREDITS “Taxes Paid To Washington State”

Column 1

Column 2

Column 3

ACTIVITY WHICH RESULTS

IN A TAX CREDIT

Business And Occupation Tax Reported

Taxable

Line

Total

Amount

Extracting

Manufacturing

Wholesaling

Retailing

Code

Credit

F.

Washington extracted products

manufactured in Washington

16

G.

Washington extracted products

sold in Washington

16

H.

Washington manufactured products

sold in Washington

07

Multiple Activities Tax Credit Subtotal

$0.00

of taxes paid to Washington State.

Enter the total credits from Part I and Part II in this box and transfer the amount to

Credit

$0.00

ID 800

the Multiple Activities Tax Credit line on the Combined Excise Tax Return

For tax assistance visit dor.wa.gov or call 1-800-647-7706. To inquire about the availability of this form in an alternate format

for the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

REV 40 0014e (11/20/06)

Print This Form

1

1