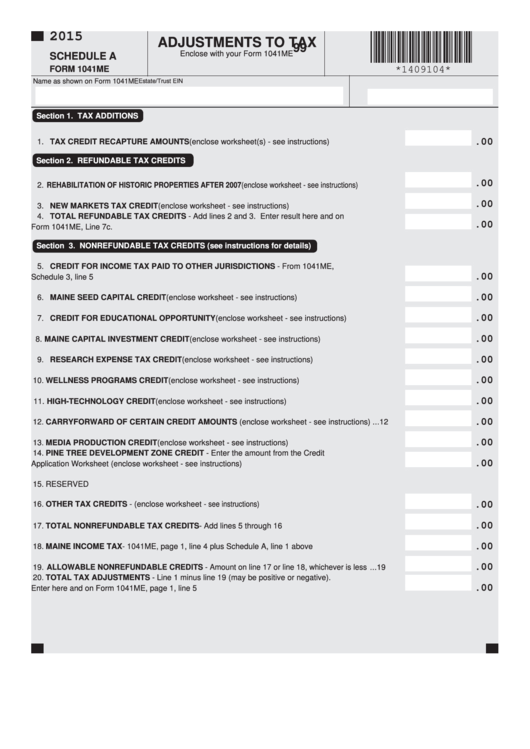

Form 1041me - Schedule A - Adjustments To Tax - 2015

ADVERTISEMENT

2015

ADJUSTMENTS TO TAX

99

Enclose with your Form 1041ME

SCHEDULE A

FORM 1041ME

*1409104*

Name as shown on Form 1041ME

Estate/Trust EIN

Section 1. TAX ADDITIONS

.00

1. TAX CREDIT RECAPTURE AMOUNTS (enclose worksheet(s) - see instructions) ....................... 1

Section 2. REFUNDABLE TAX CREDITS

.00

2. REHABILITATION OF HISTORIC PROPERTIES AFTER 2007 (enclose worksheet - see instructions) ........... 2

.00

3. NEW MARKETS TAX CREDIT (enclose worksheet - see instructions) .......................................... 3

4. TOTAL REFUNDABLE TAX CREDITS - Add lines 2 and 3. Enter result here and on

.00

Form 1041ME, Line 7c. .................................................................................................................... 4

Section 3. NONREFUNDABLE TAX CREDITS (see instructions for details)

5. CREDIT FOR INCOME TAX PAID TO OTHER JURISDICTIONS - From 1041ME,

.00

Schedule 3, line 5 ............................................................................................................................ 5

.00

6. MAINE SEED CAPITAL CREDIT (enclose worksheet - see instructions) ...................................... 6

.00

7. CREDIT FOR EDUCATIONAL OPPORTUNITY (enclose worksheet - see instructions) ............... 7

.00

8. MAINE CAPITAL INVESTMENT CREDIT (enclose worksheet - see instructions) ......................... 8

.00

9. RESEARCH EXPENSE TAX CREDIT (enclose worksheet - see instructions) .............................. 9

.00

10. WELLNESS PROGRAMS CREDIT (enclose worksheet - see instructions) ................................. 10

.00

11. HIGH-TECHNOLOGY CREDIT (enclose worksheet - see instructions) ....................................... 11

.00

12. CARRYFORWARD OF CERTAIN CREDIT AMOUNTS (enclose worksheet - see instructions) ... 12

.00

13. MEDIA PRODUCTION CREDIT (enclose worksheet - see instructions) ...................................... 13

14. PINE TREE DEVELOPMENT ZONE CREDIT - Enter the amount from the Credit

.00

Application Worksheet (enclose worksheet - see instructions) ..................................................... 14

15. RESERVED ................................................................................................................................... 15

16. OTHER TAX CREDITS - (enclose worksheet - see instructions) ..................................................... 16

.00

.00

17. TOTAL NONREFUNDABLE TAX CREDITS - Add lines 5 through 16 .......................................... 17

.00

18. MAINE INCOME TAX - 1041ME, page 1, line 4 plus Schedule A, line 1 above ............................ 18

.00

19. ALLOWABLE NONREFUNDABLE CREDITS - Amount on line 17 or line 18, whichever is less ... 19

20. TOTAL TAX ADJUSTMENTS - Line 1 minus line 19 (may be positive or negative).

.00

Enter here and on Form 1041ME, page 1, line 5 ........................................................................... 20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2