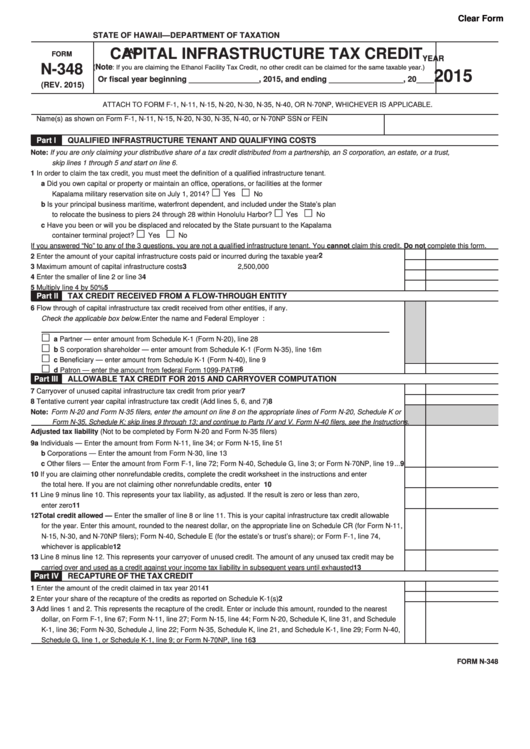

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

CAPITAL INFRASTRUCTURE TAX CREDIT

TAX

FORM

YEAR

N-348

(

Note: If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed for the same taxable year.)

2015

Or fiscal year beginning ________________, 2015, and ending _________________, 20____

(REV. 2015)

ATTACH TO FORM F-1, N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP, WHICHEVER IS APPLICABLE.

Name(s) as shown on Form F-1, N-11, N-15, N-20, N-30, N-35, N-40, or N-70NP

SSN or FEIN

Part I

QUALIFIED INFRASTRUCTURE TENANT AND QUALIFYING COSTS

Note: If you are only claiming your distributive share of a tax credit distributed from a partnership, an S corporation, an estate, or a trust,

skip lines 1 through 5 and start on line 6.

1 In order to claim the tax credit, you must meet the definition of a qualified infrastructure tenant.

a Did you own capital or property or maintain an office, operations, or facilities at the former

Kapalama military reservation site on July 1, 2014? ...................................................................................................

Yes

No

b Is your principal business maritime, waterfront dependent, and included under the State’s plan

to relocate the business to piers 24 through 28 within Honolulu Harbor? ...................................................................

Yes

No

c Have you been or will you be displaced and relocated by the State pursuant to the Kapalama

container terminal project? ..........................................................................................................................................

Yes

No

If you answered “No” to any of the 3 questions, you are not a qualified infrastructure tenant. You cannot claim this credit. Do not complete this form.

2

2 Enter the amount of your capital infrastructure costs paid or incurred during the taxable year ........................................

3 Maximum amount of capital infrastructure costs ...............................................................................................................

3

2,500,000

4 Enter the smaller of line 2 or line 3 ....................................................................................................................................

4

5 Multiply line 4 by 50% .......................................................................................................................................................

5

Part II

TAX CREDIT RECEIVED FROM A FLOW-THROUGH ENTITY

6 Flow through of capital infrastructure tax credit received from other entities, if any.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity:

a Partner — enter amount from Schedule K-1 (Form N-20), line 28 .........................................................................

b S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 16m ........................................

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9 .....................................................................

6

d Patron — enter the amount from federal Form 1099-PATR ....................................................................................

Part III

ALLOWABLE TAX CREDIT FOR 2015 AND CARRYOVER COMPUTATION

7 Carryover of unused capital infrastructure tax credit from prior year ................................................................................

7

8 Tentative current year capital infrastructure tax credit (Add lines 5, 6, and 7) ...................................................................

8

Note: Form N-20 and Form N-35 filers, enter the amount on line 8 on the appropriate lines of Form N-20, Schedule K or

Form N-35, Schedule K; skip lines 9 through 13; and continue to Parts IV and V. Form N-40 filers, see the Instructions.

Adjusted tax liability (Not to be completed by Form N-20 and Form N-35 filers)

9 a Individuals — Enter the amount from Form N-11, line 34; or Form N-15, line 51 ........................................................

b Corporations — Enter the amount from Form N-30, line 13 ........................................................................................

c Other filers — Enter the amount from Form F-1, line 72; Form N-40, Schedule G, line 3; or Form N-70NP, line 19 ...

9

10 If you are claiming other nonrefundable credits, complete the credit worksheet in the instructions and enter

10

the total here. If you are not claiming other nonrefundable credits, enter zero..................................................................

11 Line 9 minus line 10. This represents your tax liability, as adjusted. If the result is zero or less than zero,

11

enter zero ..........................................................................................................................................................................

12 Total credit allowed — Enter the smaller of line 8 or line 11. This is your capital infrastructure tax credit allowable

for the year. Enter this amount, rounded to the nearest dollar, on the appropriate line on Schedule CR (for Form N-11,

N-15, N-30, and N-70NP filers); Form N-40, Schedule E (for the estate’s or trust’s share); or Form F-1, line 74,

12

whichever is applicable .....................................................................................................................................................

13 Line 8 minus line 12. This represents your carryover of unused credit. The amount of any unused tax credit may be

13

carried over and used as a credit against your income tax liability in subsequent years until exhausted .........................

Part IV

RECAPTURE OF THE TAX CREDIT

1 Enter the amount of the credit claimed in tax year 2014 ...................................................................................................

1

2 Enter your share of the recapture of the credits as reported on Schedule K-1(s) .............................................................

2

3 Add lines 1 and 2. This represents the recapture of the credit. Enter or include this amount, rounded to the nearest

dollar, on Form F-1, line 67; Form N-11, line 27; Form N-15, line 44; Form N-20, Schedule K, line 31, and Schedule

K-1, line 36; Form N-30, Schedule J, line 22; Form N-35, Schedule K, line 21, and Schedule K-1, line 29; Form N-40,

3

Schedule G, line 1, or Schedule K-1, line 9; or Form N-70NP, line 16 ..............................................................................

FORM N-348

1

1 2

2