Worksheet For Form 1040me, Schedule 1, Line 1h

ADVERTISEMENT

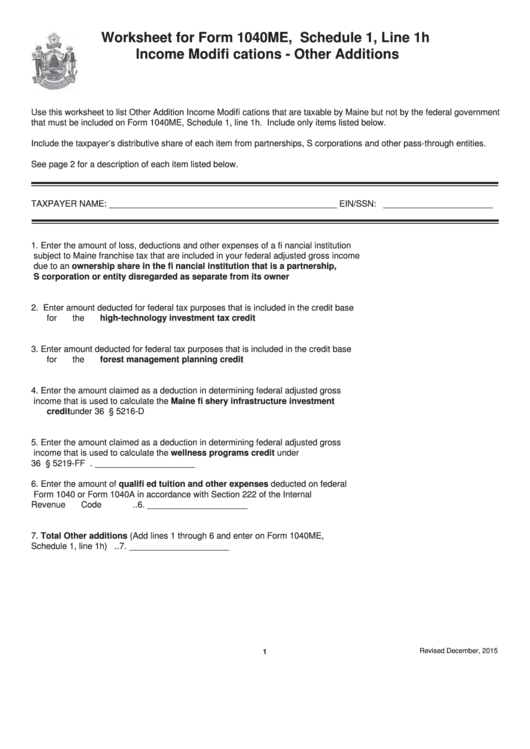

Worksheet for Form 1040ME, Schedule 1, Line 1h

Income Modifi cations - Other Additions

Use this worksheet to list Other Addition Income Modifi cations that are taxable by Maine but not by the federal government

that must be included on Form 1040ME, Schedule 1, line 1h. Include only items listed below.

Include the taxpayer’s distributive share of each item from partnerships, S corporations and other pass-through entities.

See page 2 for a description of each item listed below.

TAXPAYER NAME: ________________________________________________ EIN/SSN: _______________________

1. Enter the amount of loss, deductions and other expenses of a fi nancial institution

subject to Maine franchise tax that are included in your federal adjusted gross income

due to an ownership share in the fi nancial institution that is a partnership,

S corporation or entity disregarded as separate from its owner ................................1. _____________________

2. Enter amount deducted for federal tax purposes that is included in the credit base

for the high-technology investment tax credit ...............................................................2. _____________________

3. Enter amount deducted for federal tax purposes that is included in the credit base

for the forest management planning credit ....................................................................3. _____________________

4. Enter the amount claimed as a deduction in determining federal adjusted gross

income that is used to calculate the Maine fi shery infrastructure investment

credit under 36 M.R.S. § 5216-D ......................................................................................4. _____________________

5. Enter the amount claimed as a deduction in determining federal adjusted gross

income that is used to calculate the wellness programs credit under

36 M.R.S. § 5219-FF .........................................................................................................5. _____________________

6. Enter the amount of qualifi ed tuition and other expenses deducted on federal

Form 1040 or Form 1040A in accordance with Section 222 of the Internal

Revenue Code ...................................................................................................................6. _____________________

7. Total Other additions (Add lines 1 through 6 and enter on Form 1040ME,

Schedule 1, line 1h) ..........................................................................................................7. _____________________

Revised December, 2015

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2