Form Ct-34-Sh - New York S Corporation Shareholders' Information Schedule - 2014

ADVERTISEMENT

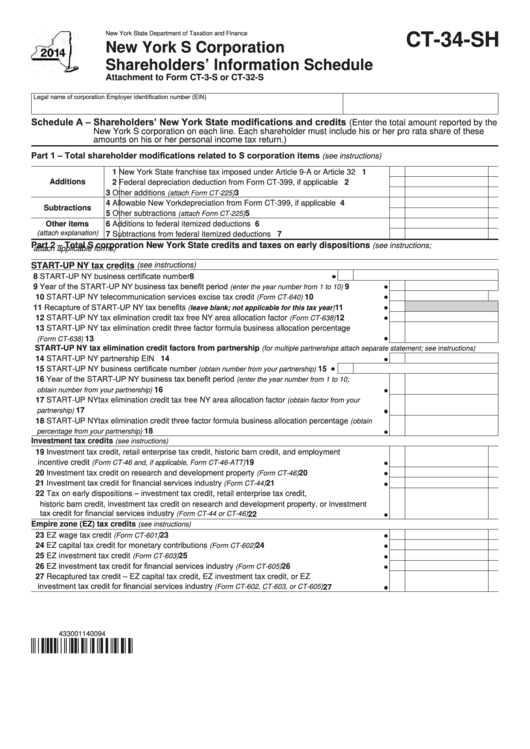

New York State Department of Taxation and Finance

CT-34-SH

New York S Corporation

Shareholders’ Information Schedule

Attachment to Form CT-3-S or CT-32-S

Legal name of corporation

Employer identification number (EIN)

Schedule A – Shareholders’ New York State modifications and credits

(Enter the total amount reported by the

New York S corporation on each line. Each shareholder must include his or her pro rata share of these

amounts on his or her personal income tax return.)

Part 1 – Total shareholder modifications related to S corporation items

(see instructions)

1 New York State franchise tax imposed under Article 9-A or Article 32 .............

1

2 Federal depreciation deduction from Form CT-399, if applicable ...................

Additions

2

3 Other additions

................................................................

3

(attach Form CT-225)

4 Allowable New York depreciation from Form CT-399, if applicable .................

4

Subtractions

5 Other subtractions

...........................................................

5

(attach Form CT-225)

6 Additions to federal itemized deductions .........................................................

Other items

6

7 Subtractions from federal itemized deductions ...............................................

(attach explanation)

7

Part 2 – Total S corporation New York State credits and taxes on early dispositions

(see instructions;

attach applicable forms)

(see instructions)

START-UP NY tax credits

8 START-UP NY business certificate number .............................................................

8

9 Year of the START-UP NY business tax benefit period

..............

9

(enter the year number from 1 to 10)

10 START-UP NY telecommunication services excise tax credit

...................................

10

(Form CT-640)

11 Recapture of START-UP NY tax benefits

...................

11

(leave blank; not applicable for this tax year)

12 START-UP NY tax elimination credit tax free NY area allocation factor

.....................

12

(Form CT-638)

13 START-UP NY tax elimination credit three factor formula business allocation percentage

................................................................................................................................

13

(Form CT-638)

START-UP NY tax elimination credit factors from partnership

(for multiple partnerships attach separate statement; see instructions)

14 START-UP NY partnership EIN .......................................................................................................

14

15 START-UP NY business certificate number

....

15

(obtain number from your partnership)

16 Year of the START-UP NY business tax benefit period

(enter the year number from 1 to 10;

................................................................................................

16

obtain number from your partnership)

17 START-UP NY tax elimination credit tax free NY area allocation factor

(obtain factor from your

....................................................................................................................................

17

partnership)

18 START-UP NY tax elimination credit three factor formula business allocation percentage

(obtain

.....................................................................................................

18

percentage from your partnership)

Investment tax credits

(see instructions)

19 Investment tax credit, retail enterprise tax credit, historic barn credit, and employment

incentive credit

......................................................

19

(Form CT-46 and, if applicable, Form CT-46-ATT)

20 Investment tax credit on research and development property

....................................

20

(Form CT-46)

21 Investment tax credit for financial services industry

....................................................

21

(Form CT-44)

22 Tax on early dispositions – investment tax credit, retail enterprise tax credit,

historic barn credit, investment tax credit on research and development property, or investment

tax credit for financial services industry

.....................................................

(Form CT-44 or CT-46)

22

Empire zone (EZ) tax credits

(see instructions)

23 EZ wage tax credit

....................................................................................................

23

(Form CT-601)

24 EZ capital tax credit for monetary contributions

........................................................

24

(Form CT-602)

25 EZ investment tax credit

............................................................................................

25

(Form CT-603)

26 EZ investment tax credit for financial services industry

............................................

26

(Form CT-605)

27 Recaptured tax credit – EZ capital tax credit, EZ investment tax credit, or EZ

investment tax credit for financial services industry

..................

(Form CT-602, CT-603, or CT-605)

27

433001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4