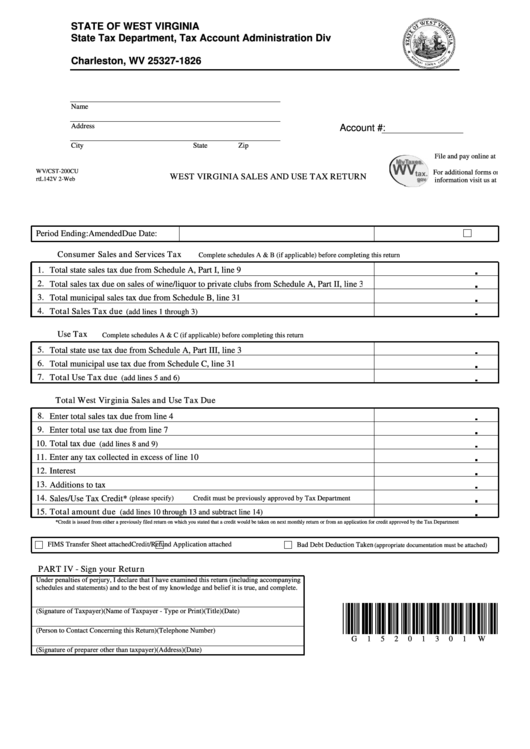

Form Wv/cst-200cu - West Virginia Sales And Use Tax Return

ADVERTISEMENT

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

Name

Address

Account #:

City

State

Zip

File and pay online at

MyTaxes.WVtax.gov.

WV/CST-200CU

For additional forms or

WEST VIRGINIA SALES AND USE TAX RETURN

rtL142V 2-Web

information visit us at

Period Ending:

Due Date:

Amended

Consumer Sales and Services Tax

Complete schedules A & B (if applicable) before completing this return

1.

Total state sales tax due from Schedule A, Part I, line 9

2.

Total sales tax due on sales of wine/liquor to private clubs from Schedule A, Part II, line 3

3.

Total municipal sales tax due from Schedule B, line 31

4.

Total Sales Tax due

(add lines 1 through 3)

Use Tax

Complete schedules A & C (if applicable) before completing this return

5.

Total state use tax due from Schedule A, Part III, line 3

6.

Total municipal use tax due from Schedule C, line 31

7.

Total Use Tax due

(add lines 5 and 6)

Total West Virginia Sales and Use Tax Due

8.

Enter total sales tax due from line 4

9.

Enter total use tax due from line 7

10.

Total tax due

(add lines 8 and 9)

11.

Enter any tax collected in excess of line 10

12.

Interest

13.

Additions to tax

14.

Sales/Use Tax Credit*

(please specify)

Credit must be previously approved by Tax Department

15.

Total amount due

(add lines 10 through 13 and subtract line 14)

*Credit is issued from either a previously filed return on which you stated that a credit would be taken on next monthly return or from an application for credit approved by the Tax Department

FIMS Transfer Sheet attached

Credit/Refund Application attached

Bad Debt Deduction Taken

(appropriate documentation must be attached)

PART IV - Sign your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying

schedules and statements) and to the best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

G

1

5

2

0

1

3

0

1

W

(Signature of preparer other than taxpayer)

(Address)

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4