Clear Form

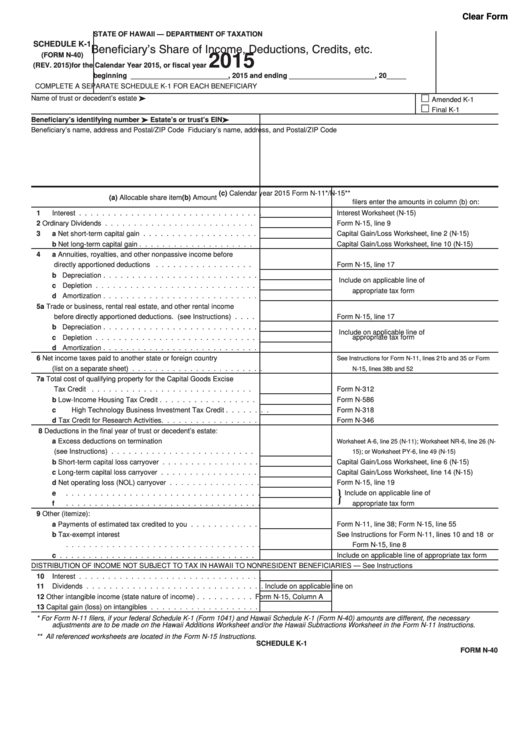

STATE OF HAWAII — DEPARTMENT OF TAXATION

Beneficiary’s Share of Income, Deductions, Credits, etc.

SCHEDULE K-1

(FORM N-40)

2015

(REV. 2015)

for the Calendar Year 2015, or fiscal year

beginning _________________________, 2015 and ending ______________________, 20_____

COMPLETE A SEPARATE SCHEDULE K-1 FOR EACH BENEFICIARY

Name of trust or decedent’s estate

Amended K-1

Final K-1

Beneficiary’s identifying number

Estate’s or trust’s EIN

Beneficiary’s name, address and Postal/ZIP Code

Fiduciary’s name, address, and Postal/ZIP Code

(c) Calendar year 2015 Form N-11*/N-15**

(a) Allocable share item

(b) Amount

filers enter the amounts in column (b) on:

1

Interest

Interest Worksheet (N-15)

2

Ordinary Dividends

Form N-15, line 9

3

a Net short-term capital gain

Capital Gain/Loss Worksheet, line 2 (N-15)

b Net long-term capital gain

Capital Gain/Loss Worksheet, line 10 (N-15)

4

a Annuities, royalties, and other nonpassive income before

directly apportioned deductions

Form N-15, line 17

b Depreciation

Include on applicable line of

c Depletion

appropriate tax form

d Amortization

5

a Trade or business, rental real estate, and other rental income

before directly apportioned deductions (see Instructions)

Form N-15, line 17

b Depreciation

Include on applicable line of

c Depletion

appropriate tax form

d Amortization

6

Net income taxes paid to another state or foreign country

See Instructions for Form N-11, lines 21b and 35 or Form

(list on a separate sheet)

N-15, lines 38b and 52

7

a Total cost of qualifying property for the Capital Goods Excise

Tax Credit

Form N-312

b Low-Income Housing Tax Credit

Form N-586

c High Technology Business Investment Tax Credit

Form N-318

d Tax Credit for Research Activities

Form N-346

8

Deductions in the final year of trust or decedent’s estate:

a Excess deductions on termination

Worksheet A-6, line 25 (N-11); Worksheet NR-6, line 26 (N-

(see Instructions)

15); or Worksheet PY-6, line 49 (N-15)

b Short-term capital loss carryover

Capital Gain/Loss Worksheet, line 6 (N-15)

c Long-term capital loss carryover

Capital Gain/Loss Worksheet, line 14 (N-15)

d Net operating loss (NOL) carryover

Form N-15, line 19

}

e

Include on applicable line of

f

appropriate tax form

9

Other (itemize):

a Payments of estimated tax credited to you

Form N-11, line 38; Form N-15, line 55

b Tax-exempt interest

See Instructions for Form N-11, lines 10 and 18 or

Form N-15, line 8

c

Include on applicable line of appropriate tax form

DISTRIBUTION OF INCOME NOT SUBJECT TO TAX IN HAWAII TO NONRESIDENT BENEFICIARIES — See Instructions

10

Interest

11

Dividends

Include on applicable line on

12

Other intangible income (state nature of income)

Form N-15, Column A

13

Capital gain (loss) on intangibles

*

For Form N-11 filers, if your federal Schedule K-1 (Form 1041) and Hawaii Schedule K-1 (Form N-40) amounts are different, the necessary

adjustments are to be made on the Hawaii Additions Worksheet and/or the Hawaii Subtractions Worksheet in the Form N-11 Instructions.

**

All referenced worksheets are located in the Form N-15 Instructions.

SCHEDULE K-1

FORM N-40

1

1 2

2