Form Cr - Maine Corporate Income Tax Combined Report For Unitary Members - 2015

ADVERTISEMENT

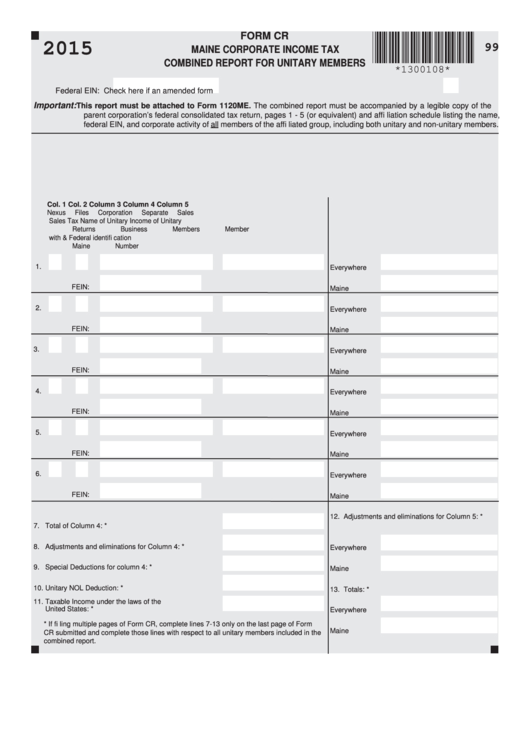

FORM CR

2015

99

MAINE CORPORATE INCOME TAX

COMBINED REPORT FOR UNITARY MEMBERS

*1300108*

Federal EIN:

Check here if an amended form

Important:

This report must be attached to Form 1120ME. The combined report must be accompanied by a legible copy of the

parent corporation’s federal consolidated tax return, pages 1 - 5 (or equivalent) and affi liation schedule listing the name,

federal EIN, and corporate activity of all members of the affi liated group, including both unitary and non-unitary members.

Col. 1 Col. 2

Column 3

Column 4

Column 5

Nexus

Files

Corporation

Separate

Sales

Sales Tax

Name of Unitary

Income of Unitary

Returns

Business Members

Member

with

& Federal identifi cation

Maine

Number

1.

Everywhere

FEIN:

Maine

2.

Everywhere

FEIN:

Maine

3.

Everywhere

FEIN:

Maine

4.

Everywhere

FEIN:

Maine

5.

Everywhere

FEIN:

Maine

6.

Everywhere

FEIN:

Maine

12. Adjustments and eliminations for Column 5: *

7. Total of Column 4: *

8. Adjustments and eliminations for Column 4: *

Everywhere

9. Special Deductions for column 4: *

Maine

10. Unitary NOL Deduction: *

13. Totals: *

11. Taxable Income under the laws of the

United States: *

Everywhere

* If fi ling multiple pages of Form CR, complete lines 7-13 only on the last page of Form

Maine

CR submitted and complete those lines with respect to all unitary members included in the

combined report.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1