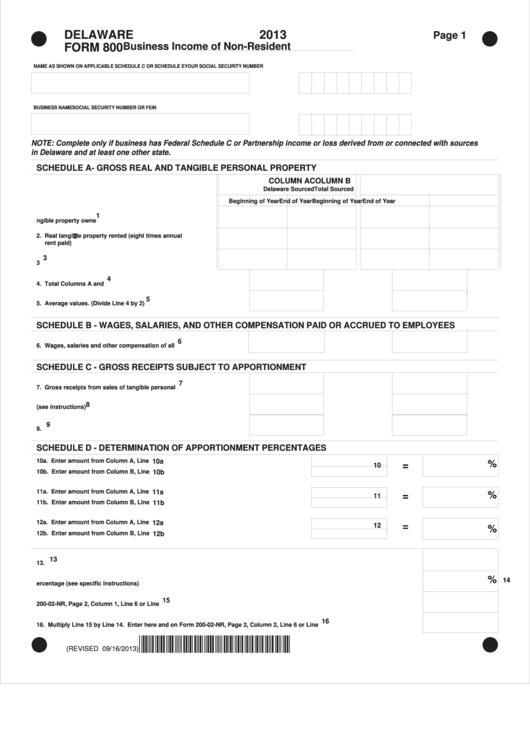

Delaware Form 800 - Business Income Of Non-Resident - 2013

ADVERTISEMENT

DELAWARE

2013

Page 1

Business Income of Non-Resident

FORM 800

NAME AS SHOWN ON APPLICABLE SCHEDULE C OR SCHEDULE E

YOUR SOCIAL SECURITY NUMBER

BUSINESS NAME

SOCIAL SECURITY NUMBER OR FEIN

NOTE: Complete only if business has Federal Schedule C or Partnership income or loss derived from or connected with sources

in Delaware and at least one other state.

SCHEDULE A - GROSS REAL AND TANGIBLE PERSONAL PROPERTY

COLUMN A

COLUMN B

Delaware Sourced

Total Sourced

Beginning of Year

End of Year

Beginning of Year

End of Year

1

1. Total real and tangible property owned..................................

2. Real tangible property rented (eight times annual

2

rent paid)....................................................................................

3

3 Total..............................................................................................

.

4

4. Total Columns A and B................................................................................

....

5

5. Average values. (Divide Line 4 by 2)..........................................................

SCHEDULE B - WAGES, SALARIES, AND OTHER COMPENSATION PAID OR ACCRUED TO EMPLOYEES

6

6. Wages, salaries and other compensation of all employees.....................

SCHEDULE C - GROSS RECEIPTS SUBJECT TO APPORTIONMENT

7

7. Gross receipts from sales of tangible personal property.........................

8

8. Gross income from other sources (see instructions)...............................

9

9. Total...............................................................................................................

SCHEDULE D - DETERMINATION OF APPORTIONMENT PERCENTAGES

10a. Enter amount from Column A, Line 5........................................................................

10a

%

=

10

10b. Enter amount from Column B, Line 5........................................................................

10b

11a. Enter amount from Column A, Line 6........................................................................

11a

%

=

11

11b. Enter amount from Column B, Line 6........................................................................

11b

12a. Enter amount from Column A, Line 9........................................................................

12a

=

12

%

12b. Enter amount from Column B, Line 9........................................................................

12b

13

13. Total......................................................................................................................................................................................................................

.

%

14

14. Apportionment percentage (see specific instructions)....................................................................................................................................

15

15. Amount from Form 200-02-NR, Page 2, Column 1, Line 6 or Line 10.............................................................................................................

16

16. Multiply Line 15 by Line 14. Enter here and on Form 200-02-NR, Page 2, Column 2, Line 6 or Line 10....................................................

*DF30513019999*

(REVISED 09/16/2013)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2