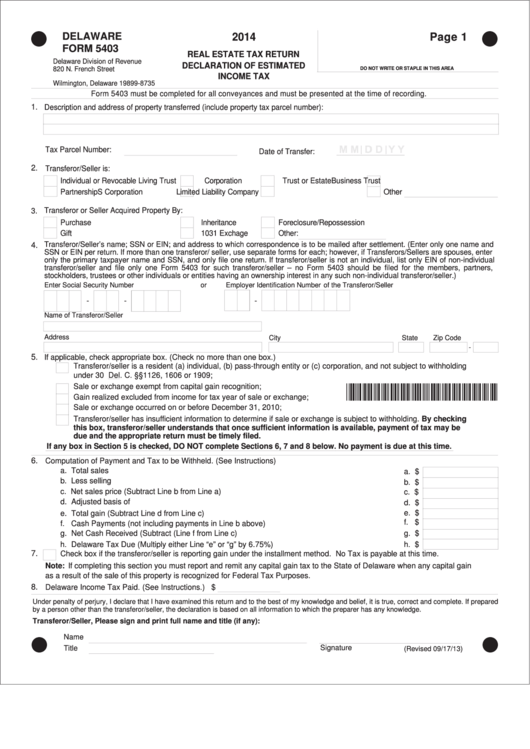

Delaware Form 5403 - Real Estate Tax Return - Declaration Of Estimated Income Tax - 2014

ADVERTISEMENT

DELAWARE

2014

Page 1

FORM 5403

REAL ESTATE TAX RETURN

Delaware Division of Revenue

DECLARATION OF ESTIMATED

820 N. French Street

DO NOT WRITE OR STAPLE IN THIS AREA

INCOME TAX

P.O. Box 8735

Wilmington, Delaware 19899-8735

Form 5403 must be completed for all conveyances and must be presented at the time of recording.

1.

Description and address of property transferred (include property tax parcel number):

Tax Parcel Number:

Date of Transfer:

2.

Transferor/Seller is:

Individual or Revocable Living Trust

Corporation

Trust or Estate

Business Trust

Partnership

S Corporation

Limited Liability Company

Other

Transferor or Seller Acquired Property By:

3.

Purchase

Inheritance

Foreclosure/Repossession

Gift

1031 Exchage

Other:

4.

Transferor/Seller’s name; SSN or EIN; and address to which correspondence is to be mailed after settlement. (Enter only one name and

SSN or EIN per return. If more than one transferor/ seller, use separate forms for each; however, if Transferors/Sellers are spouses, enter

only the primary taxpayer name and SSN, and only file one return. If transferor/seller is not an individual, list only EIN of non-individual

transferor/seller and file only one Form 5403 for such transferor/seller – no Form 5403 should be filed for the members, partners,

stockholders, trustees or other individuals or entities having an ownership interest in any such non-individual transferor/seller.)

Enter Social Security Number

or

Employer Identification Number of the Transferor/Seller

-

-

-

Name of Transferor/Seller

Address

City

State

Zip Code

-

5.

If applicable, check appropriate box. (Check no more than one box.)

Transferor/seller is a resident (a) individual, (b) pass-through entity or (c) corporation, and not subject to withholding

under 30 Del. C. §§1126, 1606 or 1909;

Sale or exchange exempt from capital gain recognition;

*DF24013019999*

Gain realized excluded from income for tax year of sale or exchange;

Sale or exchange occurred on or before December 31, 2010;

Transferor/seller has insufficient information to determine if sale or exchange is subject to withholding. By checking

this box, transferor/seller understands that once sufficient information is available, payment of tax may be

due and the appropriate return must be timely filed.

If any box in Section 5 is checked, DO NOT complete Sections 6, 7 and 8 below . No payment is due at this time.

6.

Computation of Payment and Tax to be Withheld. (See Instructions)

a. Total sales price...............................................................................................................................

a. $

b. Less selling expenses......................................................................................................................

b. $

c. Net sales price (Subtract Line b from Line a)...................................................................................

c. $

d. Adjusted basis of property................................................................................................................

d. $

e. Total gain (Subtract Line d from Line c)............................................................................................

e. $

f. $

f. Cash Payments (not including payments in Line b above)...............................................................

g. Net Cash Received (Subtract (Line f from Line c)............................................................................

g. $

h. $

h. Delaware Tax Due (Multiply either Line “e” or “g” by 6.75%)...........................................................

7.

Check box if the transferor/seller is reporting gain under the installment method. No Tax is payable at this time.

Note: If completing this section you must report and remit any capital gain tax to the State of Delaware when any capital gain

as a result of the sale of this property is recognized for Federal Tax Purposes.

8.

Delaware Income Tax Paid. (See Instructions.) $

Under penalty of perjury, I declare that I have examined this return and to the best of my knowledge and belief, it is true, correct and complete. If prepared

by a person other than the transferor/seller, the declaration is based on all information to which the preparer has any knowledge.

Transferor/Seller, Please sign and print full name and title (if any):

Name

Title

Signature

(Revised 09/17/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2