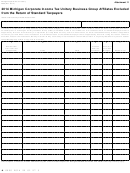

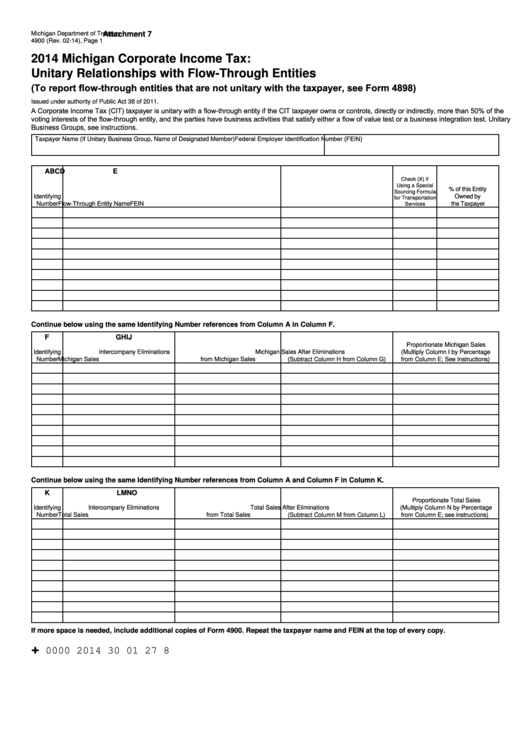

Form 4900 - Michigan Corporate Income Tax - Unitary Relationships With Flow-Through Entities - 2014

ADVERTISEMENT

Michigan Department of Treasury

Attachment 7

4900 (Rev. 02-14), Page 1

2014 Michigan Corporate Income Tax:

Unitary Relationships with Flow-Through Entities

(To report flow-through entities that are not unitary with the taxpayer, see Form 4898)

Issued under authority of Public Act 38 of 2011.

A Corporate Income Tax (CIT) taxpayer is unitary with a flow-through entity if the CIT taxpayer owns or controls, directly or indirectly, more than 50% of the

voting interests of the flow-through entity, and the parties have business activities that satisfy either a flow of value test or a business integration test. Unitary

Business Groups, see instructions.

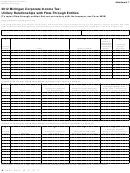

Federal Employer Identification Number (FEIN)

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

A

B

C

D

E

Check (X) if

Using a Special

% of this Entity

Sourcing Formula

Identifying

Owned by

for Transportation

Number

Flow-Through Entity Name

FEIN

the Taxpayer

Services

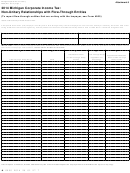

Continue below using the same Identifying Number references from Column A in Column F.

F

G

h

I

J

Proportionate Michigan Sales

Identifying

Intercompany Eliminations

Michigan Sales After Eliminations

(Multiply Column I by Percentage

Number

Michigan Sales

from Michigan Sales

(Subtract Column H from Column G)

from Column E; See Instructions)

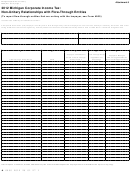

Continue below using the same Identifying Number references from Column A and Column F in Column k.

k

L

M

N

O

Proportionate Total Sales

Identifying

Intercompany Eliminations

Total Sales After Eliminations

(Multiply Column N by Percentage

Number

Total Sales

from Total Sales

(Subtract Column M from Column L)

from Column E; see instructions)

If more space is needed, include additional copies of Form 4900. Repeat the taxpayer name and FEIN at the top of every copy.

+

0000 2014 30 01 27 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5