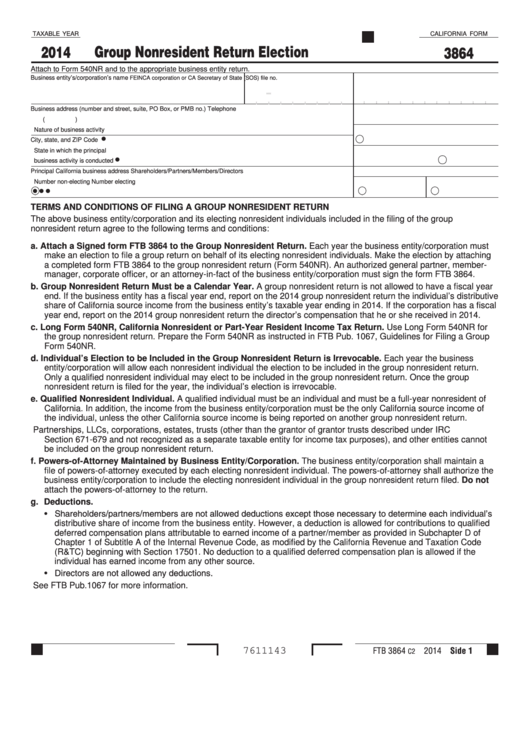

California Form 3864 - Group Nonresident Return Election - 2014

ADVERTISEMENT

CALIFORNIA FORM

TAXABLE YEAR

Group Nonresident Return Election

2014

3864

Attach to Form 540NR and to the appropriate business entity return .

Business entity’s/corporation’s name

FEIN

CA corporation or CA Secretary of State (SOS) file no .

Business address (number and street, suite, PO Box, or PMB no .)

Telephone

(

)

Nature of business activity

City, state, and ZIP Code

State in which the principal

business activity is conducted

Principal California business address

Shareholders/Partners/Members/Directors

Number non-electing

Number electing

TERMS AND CONDITIONS OF FILING A GROUP NONRESIDENT RETURN

The above business entity/corporation and its electing nonresident individuals included in the filing of the group

nonresident return agree to the following terms and conditions:

a. Attach a Signed form FTB 3864 to the Group Nonresident Return. Each year the business entity/corporation must

make an election to file a group return on behalf of its electing nonresident individuals . Make the election by attaching

a completed form FTB 3864 to the group nonresident return (Form 540NR) . An authorized general partner, member-

manager, corporate officer, or an attorney-in-fact of the business entity/corporation must sign the form FTB 3864 .

b. Group Nonresident Return Must be a Calendar Year. A group nonresident return is not allowed to have a fiscal year

end . If the business entity has a fiscal year end, report on the 2014 group nonresident return the individual’s distributive

share of California source income from the business entity’s taxable year ending in 2014 . If the corporation has a fiscal

year end, report on the 2014 group nonresident return the director’s compensation that he or she received in 2014 .

c. Long Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Use Long Form 540NR for

the group nonresident return . Prepare the Form 540NR as instructed in FTB Pub . 1067, Guidelines for Filing a Group

Form 540NR .

d. Individual’s Election to be Included in the Group Nonresident Return is Irrevocable. Each year the business

entity/corporation will allow each nonresident individual the election to be included in the group nonresident return .

Only a qualified nonresident individual may elect to be included in the group nonresident return . Once the group

nonresident return is filed for the year, the individual’s election is irrevocable .

e. Qualified Nonresident Individual. A qualified individual must be an individual and must be a full-year nonresident of

California . In addition, the income from the business entity/corporation must be the only California source income of

the individual, unless the other California source income is being reported on another group nonresident return .

Partnerships, LLCs, corporations, estates, trusts (other than the grantor of grantor trusts described under IRC

Section 671-679 and not recognized as a separate taxable entity for income tax purposes), and other entities cannot

be included on the group nonresident return .

f. Powers-of-Attorney Maintained by Business Entity/Corporation. The business entity/corporation shall maintain a

file of powers-of-attorney executed by each electing nonresident individual . The powers-of-attorney shall authorize the

business entity/corporation to include the electing nonresident individual in the group nonresident return filed . Do not

attach the powers-of-attorney to the return .

g. Deductions.

• Shareholders/partners/members are not allowed deductions except those necessary to determine each individual’s

distributive share of income from the business entity . However, a deduction is allowed for contributions to qualified

deferred compensation plans attributable to earned income of a partner/member as provided in Subchapter D of

Chapter 1 of Subtitle A of the Internal Revenue Code, as modified by the California Revenue and Taxation Code

(R&TC) beginning with Section 17501 . No deduction to a qualified deferred compensation plan is allowed if the

individual has earned income from any other source .

• Directors are not allowed any deductions.

See FTB Pub .1067 for more information .

FTB 3864

2014 Side 1

7611143

C2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2