Form Ct-33-D - Tax On Premiums Paid Or Payable To An Unauthorized Insurer

ADVERTISEMENT

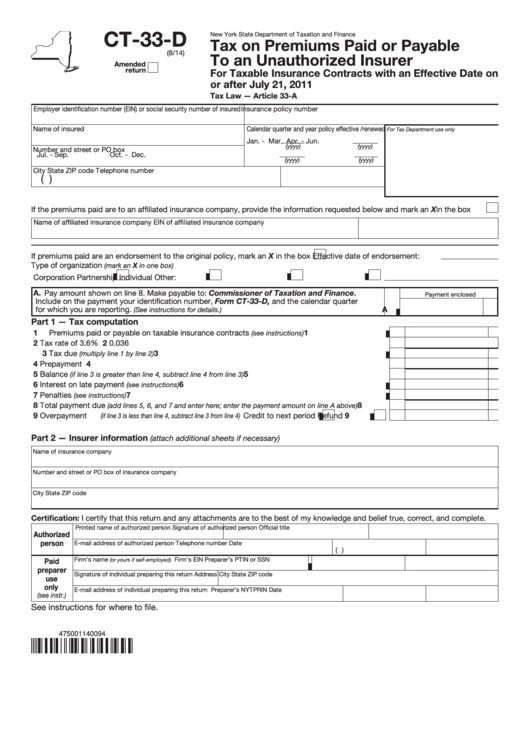

CT-33-D

New York State Department of Taxation and Finance

Tax on Premiums Paid or Payable

(8/14)

To an Unauthorized Insurer

Amended

return

For Taxable Insurance Contracts with an Effective Date on

or after July 21, 2011

Tax Law — Article 33-A

Employer identification number (EIN) or social security number of insured

Insurance policy number

Name of insured

Calendar quarter and year policy effective /renewed

For Tax Department use only

Jan. - Mar.

Apr. - Jun.

(yyyy)

(yyyy)

Number and street or PO box

Jul. - Sep.

Oct. - Dec.

(yyyy)

(yyyy)

City

State

ZIP code

Telephone number

(

)

If the premiums paid are to an affiliated insurance company, provide the information requested below and mark an X in the box .....

Name of affiliated insurance company

EIN of affiliated insurance company

If premiums paid are an endorsement to the original policy, mark an X in the box

Effective date of endorsement:

Type of organization

(mark an X in one box)

Corporation

Partnership

Individual

Other:

A. Pay amount shown on line 8. Make payable to: Commissioner of Taxation and Finance.

Payment enclosed

Include on the payment your identification number, Form CT-33-D, and the calendar quarter

for which you are reporting.

A

(See instructions for details.)

Part 1 — Tax computation

1 Premiums paid or payable on taxable insurance contracts

..................................

1

(see instructions)

2 Tax rate of 3.6% ................................................................................................................................

2

0.036

3 Tax due

........................................................................................................

3

(multiply line 1 by line 2)

4 Prepayment .......................................................................................................................................

4

5 Balance

5

............................................................

(if line 3 is greater than line 4, subtract line 4 from line 3)

6 Interest on late payment

........................................................................................

6

(see instructions)

7 Penalties

................................................................................................................

7

(see instructions)

8 Total payment due

8

.........

(add lines 5, 6, and 7 and enter here; enter the payment amount on line A above)

9 Overpayment

9

Credit to next period

Refund

(if line 3 is less than line 4, subtract line 3 from line 4)

Part 2 — Insurer information

(attach additional sheets if necessary)

Name of insurance company

Number and street or PO box of insurance company

City

State

ZIP code

Certification: I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

475001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1