Form Ct-33-A - Life Insurance Corporation Combined Franchise Tax Return - 2014

ADVERTISEMENT

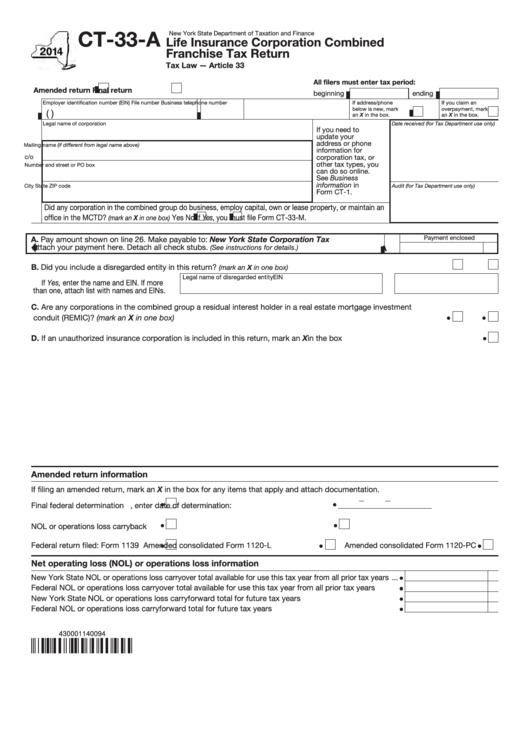

CT-33-A

New York State Department of Taxation and Finance

Life Insurance Corporation Combined

Franchise Tax Return

Tax Law — Article 33

All filers must enter tax period:

Amended return

Final return

beginning

ending

Employer identification number (EIN)

File number

Business telephone number

If address/phone

If you claim an

below is new, mark

overpayment, mark

(

)

an X in the box.

an X in the box.

Legal name of corporation

Date received (for Tax Department use only)

If you need to

update your

address or phone

Mailing name (if different from legal name above)

information for

c/o

corporation tax, or

other tax types, you

Number and street or PO box

can do so online.

See Business

information in

City

State

ZIP code

Audit (for Tax Department use only)

Form CT-1.

Did any corporation in the combined group do business, employ capital, own or lease property, or maintain an

If Yes, you must file Form CT-33-M.

office in the MCTD?

Yes

No

(mark an X in one box)

A. Pay amount shown on line 26. Make payable to: New York State Corporation Tax

Payment enclosed

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

B. Did you include a disregarded entity in this return?

.............................................................. Yes

No

(mark an X in one box)

Legal name of disregarded entity

EIN

If Yes, enter the name and EIN. If more

than one, attach list with names and EINs.

C. Are any corporations in the combined group a residual interest holder in a real estate mortgage investment

conduit (REMIC)? (mark an X in one box) ............................................................................................................... Yes

No

D. If an unauthorized insurance corporation is included in this return, mark an X in the box ..............................................................

Amended return information

If filing an amended return, mark an X in the box for any items that apply and attach documentation.

Final federal determination ...............

If marked, enter date of determination:

NOL or operations loss carryback .....

Capital loss carryback ..........................

Federal return filed:

Form 1139

Amended consolidated Form 1120-L

Amended consolidated Form 1120-PC

Net operating loss (NOL) or operations loss information

New York State NOL or operations loss carryover total available for use this tax year from all prior tax years ...

Federal NOL or operations loss carryover total available for use this tax year from all prior tax years ..........

New York State NOL or operations loss carryforward total for future tax years .............................................

Federal NOL or operations loss carryforward total for future tax years ..........................................................

430001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8