Instructions For Delaware Form 200-02-X-I - Non-Resident Amended Delaware Personal Income Tax Return - 2013

ADVERTISEMENT

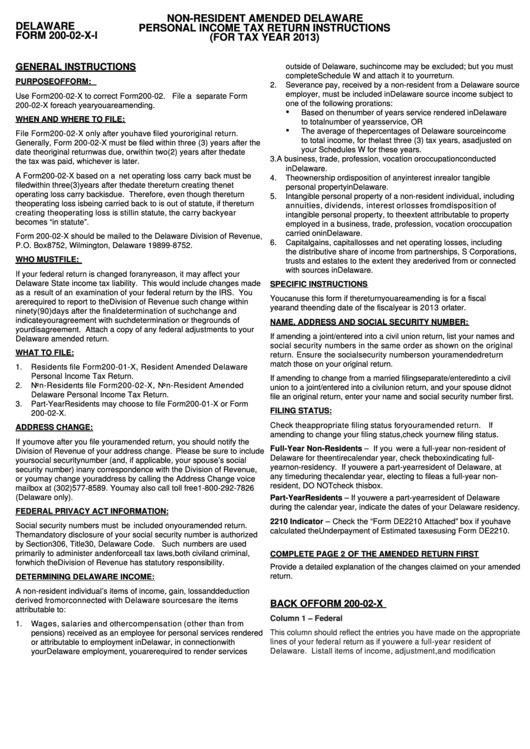

NON-RESIDENT AMENDED DELAWARE

DELAWARE

PERSONAL INCOME TAX RETURN INSTRUCTIONS

FORM 200-02-X-I

(FOR TAX YEAR 2013)

GENERAL INSTRUCTIONS

outside of Delaware, such income may be excluded; but you must

complete Schedule W and attach it to your return.

PURPOSE OF FORM:

2.

Severance pay, received by a non-resident from a Delaware source

employer, must be included in Delaware source income subject to

Use Form 200-02-X to correct Form 200-02. File a separate Form

one of the following prorations:

200-02-X for each year you are amending.

•

Based on the number of years service rendered in Delaware

WHEN AND WHERE TO FILE:

to total number of years service, OR

•

The average of the percentages of Delaware source income

File Form 200-02-X only after you have filed your original return.

to total income, for the last three (3) tax years, as adjusted on

Generally, Form 200-02-X must be filed within three (3) years after the

your Schedules W for these years.

date the original return was due, or within two (2) years after the date

3.

A business, trade, profession, vocation or occupation conducted

the tax was paid, whichever is later.

in Delaware.

A Form 200-02-X based on a net operating loss carry back must be

4.

The ownership or disposition of any interest in real or tangible

filed within three (3) years after the date the return creating the net

personal property in Delaware.

operating loss carry back is due. Therefore, even though the return

5.

Intangible personal property of a non-resident individual, including

the operating loss is being carried back to is out of statute, if the return

annuities, dividends, interest or losses from disposition of

creating the operating loss is still in statute, the carry back year

intangible personal property, to the extent attributable to property

becomes “in statute”.

employed in a business, trade, profession, vocation or occupation

carried on in Delaware.

Form 200-02-X should be mailed to the Delaware Division of Revenue,

6.

Capital gains, capital losses and net operating losses, including

P.O. Box 8752, Wilmington, Delaware 19899-8752.

the distributive share of income from partnerships, S Corporations,

WHO MUST FILE:

trusts and estates to the extent they are derived from or connected

with sources in Delaware.

If your federal return is changed for any reason, it may affect your

Delaware State income tax liability. This would include changes made

SPECIFIC INSTRUCTIONS

as a result of an examination of your federal return by the IRS. You

You can use this form if the return you are amending is for a fiscal

are required to report to the Division of Revenue such change within

year and the ending date of the fiscal year is 2013 or later.

ninety (90) days after the final determination of such change and

indicate your agreement with such determination or the grounds of

NAME, ADDRESS AND SOCIAL SECURITY NUMBER:

your disagreement. Attach a copy of any federal adjustments to your

If amending a joint/entered into a civil union return, list your names and

Delaware amended return.

social security numbers in the same order as shown on the original

WHAT TO FILE:

return. Ensure the social security numbers on your amended return

match those on your original return.

1.

Residents file Form 200-01-X, Resident Amended Delaware

Personal Income Tax Return.

If amending to change from a married filing separate/entered into a civil

2.

Non-Residents file Form 200-02-X, Non-Resident Amended

union to a joint/entered into a civil union return, and your spouse did not

Delaware Personal Income Tax Return.

file an original return, enter your name and social security number first.

3.

Part-Year Residents may choose to file Form 200-01-X or Form

FILING STATUS:

200-02-X.

Check the appropriate filing status for your amended return. If

ADDRESS CHANGE:

amending to change your filing status, check your new filing status.

If you move after you file your amended return, you should notify the

Full-Year Non-Residents – If you were a full-year non-resident of

Division of Revenue of your address change. Please be sure to include

Delaware for the entire calendar year, check the box indicating full-

your social security number (and, if applicable, your spouse’s social

year non-residency. If you were a part-year resident of Delaware, at

security number) in any correspondence with the Division of Revenue,

any time during the calendar year, electing to file as a full-year non-

or you may change your address by calling the Address Change voice

resident, DO NOT check this box.

mailbox at (302) 577-8589. You may also call toll free 1-800-292-7826

(Delaware only).

Part-Year Residents – If you were a part-year resident of Delaware

during the calendar year, indicate the dates of your Delaware residency.

FEDERAL PRIVACY ACT INFORMATION:

2210 Indicator – Check the “Form DE2210 Attached” box if you have

Social security numbers must be included on your amended return.

calculated the Underpayment of Estimated taxes using Form DE2210.

The mandatory disclosure of your social security number is authorized

by Section 306, Title 30, Delaware Code. Such numbers are used

primarily to administer and enforce all tax laws, both civil and criminal,

COMPLETE PAGE 2 OF THE AMENDED RETURN FIRST

for which the Division of Revenue has statutory responsibility.

Provide a detailed explanation of the changes claimed on your amended

return.

DETERMINING DELAWARE INCOME:

A non-resident individual’s items of income, gain, loss and deduction

derived from or connected with Delaware sources are the items

BACK OF FORM 200-02-X

attributable to:

Column 1 – Federal

1.

Wages, salaries and other compensation (other than from

This column should reflect the entries you have made on the appropriate

pensions) received as an employee for personal services rendered

or attributable to employment in Delaware. If, in connection with

lines of your federal return as if you were a full-year resident of

Delaware. List all items of income, adjustment, and modification

your Delaware employment, you are required to render services

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6