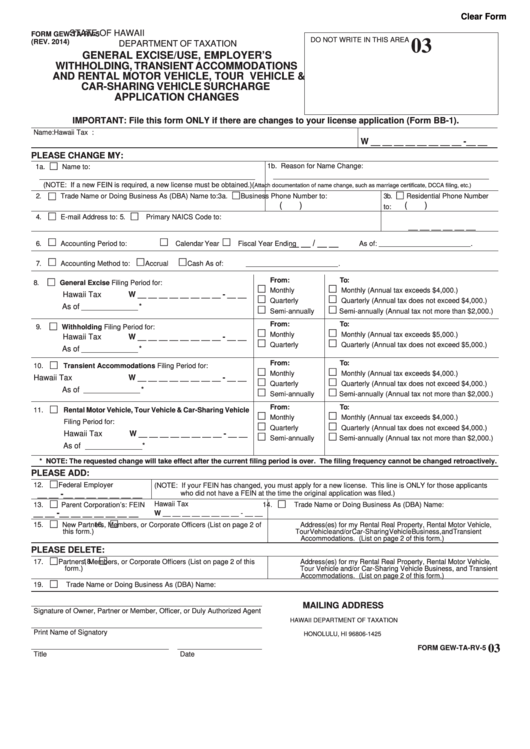

Clear Form

STATE OF HAWAII

FORM GEW-TA-RV-5

DO NOT WRITE IN THIS AREA

03

(REV. 2014)

DEPARTMENT OF TAXATION

GENERAL EXCISE/USE, EMPLOYER’S

WITHHOLDING, TRANSIENT ACCOMMODATIONS

AND RENTAL MOTOR VEHICLE, TOUR VEHICLE &

CAR-SHARING VEHICLE SURCHARGE

APPLICATION CHANGES

IMPORTANT: File this form ONLY if there are changes to your license application (Form BB-1).

Name:

Hawaii Tax I.D. No.:

W __ __ __ __ __ __ __ __ -__ __

PLEASE CHANGE MY:

1b. Reason for Name Change:

1a.

Name to:

(Attach documentation of name change, such as marriage certificate, DCCA filing, etc.)

(NOTE: If a new FEIN is required, a new license must be obtained.)

2.

Trade Name or Doing Business As (DBA) Name to:

3a.

Business Phone Number to:

3b.

Residential Phone Number

(

)

(

)

to:

4.

E-mail Address to:

5.

Primary NAICS Code to:

__ __ __ __ __ __

__ __ / __ __

6.

Accounting Period to:

Calendar Year

Fiscal Year Ending

As of:

.

7.

Accounting Method to:

Accrual

Cash As of:

.

From:

To:

8.

General Excise Filing Period for:

Monthly

Monthly (Annual tax exceeds $4,000.)

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __ - __ __

Quarterly

Quarterly (Annual tax does not exceed $4,000.)

As of

*

Semi-annually

Semi-annually (Annual tax not more than $2,000.)

From:

To:

9.

Withholding Filing Period for:

Monthly

Monthly (Annual tax exceeds $5,000.)

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __ - __ __

Quarterly

Quarterly (Annual tax does not exceed $5,000.)

As of

*

From:

To:

10.

Transient Accommodations Filing Period for:

Monthly

Monthly (Annual tax exceeds $4,000.)

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __ - __ __

Quarterly

Quarterly (Annual tax does not exceed $4,000.)

As of

*

Semi-annually

Semi-annually (Annual tax not more than $2,000.)

From:

To:

11.

Rental Motor Vehicle, Tour Vehicle & Car-Sharing Vehicle

Monthly

Monthly (Annual tax exceeds $4,000.)

Filing Period for:

Quarterly

Quarterly (Annual tax does not exceed $4,000.)

Hawaii Tax I.D. No. W __ __ __ __ __ __ __ __ - __ __

Semi-annually

Semi-annually (Annual tax not more than $2,000.)

As of

*

* NOTE: The requested change will take effect after the current filing period is over. The filing frequency cannot be changed retroactively.

PLEASE ADD:

12.

Federal Employer I.D. No.

(NOTE: If your FEIN has changed, you must apply for a new license. This line is ONLY for those applicants

__ __ -__ __ __ __ __ __ __

who did not have a FEIN at the time the original application was filed.)

Hawaii Tax I.D. No.

13.

Parent Corporation’s: FEIN

14.

Trade Name or Doing Business As (DBA) Name:

__ __ -__ __ __ __ __ __ __

W __ __ __ __ __ __ __ __ - __ __

15.

New Partners, Members, or Corporate Officers (List on page 2 of

16.

Address(es) for my Rental Real Property, Rental Motor Vehicle,

this form.)

Tour Vehicle and/or Car-Sharing Vehicle Business, and Transient

Accommodations. (List on page 2 of this form.)

PLEASE DELETE:

17.

Partners, Members, or Corporate Officers (List on page 2 of this

18.

Address(es) for my Rental Real Property, Rental Motor Vehicle,

form.)

Tour Vehicle and/or Car-Sharing Vehicle Business, and Transient

Accommodations. (List on page 2 of this form.)

19.

Trade Name or Doing Business As (DBA) Name:

MAILING ADDRESS

Signature of Owner, Partner or Member, Officer, or Duly Authorized Agent

HAWAII DEPARTMENT OF TAXATION

P.O. BOX 1425

Print Name of Signatory

HONOLULU, HI 96806-1425

03

FORM GEW-TA-RV-5

Title

Date

1

1 2

2