HELP

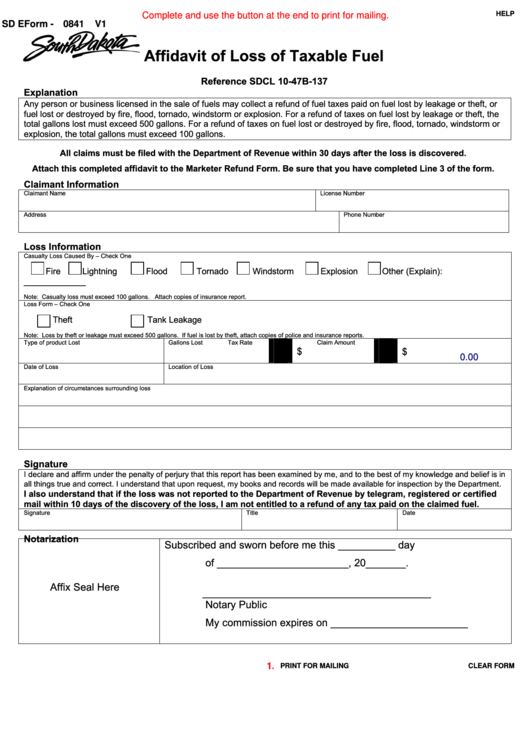

Complete and use the button at the end to print for mailing.

SD EForm - 0841

V1

Affidavit of Loss of Taxable Fuel

Reference SDCL 10-47B-137

Explanation

Any person or business licensed in the sale of fuels may collect a refund of fuel taxes paid on fuel lost by leakage or theft, or

fuel lost or destroyed by fire, flood, tornado, windstorm or explosion. For a refund of taxes on fuel lost by leakage or theft, the

total gallons lost must exceed 500 gallons. For a refund of taxes on fuel lost or destroyed by fire, flood, tornado, windstorm or

explosion, the total gallons must exceed 100 gallons.

All claims must be filed with the Department of Revenue within 30 days after the loss is discovered.

Attach this completed affidavit to the Marketer Refund Form. Be sure that you have completed Line 3 of the form.

Claimant Information

Claimant Name

License Number

Address

Phone Number

Loss Information

Casualty Loss Caused By – Check One

Fire

Lightning

Flood

Tornado

Windstorm

Explosion

Other (Explain):

_____________

Note: Casualty loss must exceed 100 gallons. Attach copies of insurance report.

Loss Form – Check One

Theft

Tank Leakage

Note: Loss by theft or leakage must exceed 500 gallons. If fuel is lost by theft, attach copies of police and insurance reports.

Type of product Lost

Gallons Lost

Tax Rate

Claim Amount

X

=

$

$

0.00

Date of Loss

Location of Loss

Explanation of circumstances surrounding loss

Signature

I declare and affirm under the penalty of perjury that this report has been examined by me, and to the best of my knowledge and belief is in

.

all things true and correct. I understand that upon request, my books and records will be made available for inspection by the Department

I also understand that if the loss was not reported to the Department of Revenue by telegram, registered or certified

mail within 10 days of the discovery of the loss, I am not entitled to a refund of any tax paid on the claimed fuel.

Signature

Title

Date

Notarization

Subscribed and sworn before me this __________ day

of _______________________, 20_______.

Affix Seal Here

________________________________________

Notary Public

My commission expires on ________________________

1.

PRINT FOR MAILING

CLEAR FORM

1

1