Form Npo - Retail Sales And Use Tax Exemption Instructions

ADVERTISEMENT

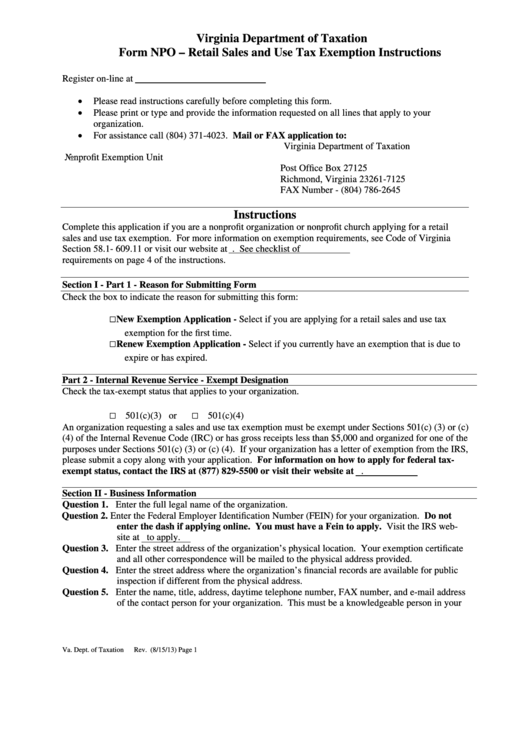

Virginia Department of Taxation

Form NPO – Retail Sales and Use Tax Exemption Instructions

Register on-line at https://

Please read instructions carefully before completing this form.

Please print or type and provide the information requested on all lines that apply to your

organization.

For assistance call (804) 371-4023.

Mail or FAX application to:

Virginia Department of Taxation

Nonprofit Exemption Unit

Post Office Box 27125

Richmond, Virginia 23261-7125

FAX Number - (804) 786-2645

Instructions

Complete this application if you are a nonprofit organization or nonprofit church applying for a retail

sales and use tax exemption. For more information on exemption requirements, see Code of Virginia

Section 58.1- 609.11 or visit our website at See checklist of

requirements on page 4 of the instructions.

Section I - Part 1 - Reason for Submitting Form

Check the box to indicate the reason for submitting this form:

□

New Exemption Application - Select if you are applying for a retail sales and use tax

exemption for the first time.

□

Renew Exemption Application - Select if you currently have an exemption that is due to

expire or has expired.

Part 2 - Internal Revenue Service - Exempt Designation

Check the tax-exempt status that applies to your organization.

□

□

501(c)(3) or

501(c)(4)

An organization requesting a sales and use tax exemption must be exempt under Sections 501(c) (3) or (c)

(4) of the Internal Revenue Code (IRC) or has gross receipts less than $5,000 and organized for one of the

purposes under Sections 501(c) (3) or (c) (4). If your organization has a letter of exemption from the IRS,

please submit a copy along with your application. For information on how to apply for federal tax-

exempt status, contact the IRS at (877) 829-5500 or visit their website at .

Section II - Business Information

Question 1. Enter the full legal name of the organization.

Question 2. Enter the Federal Employer Identification Number (FEIN) for your organization. Do not

enter the dash if applying online. You must have a Fein to apply. Visit the IRS web-

site at to apply.

Question 3. Enter the street address of the organization’s physical location. Your exemption certificate

and all other correspondence will be mailed to the physical address provided.

Question 4. Enter the street address where the organization’s financial records are available for public

inspection if different from the physical address.

Question 5. Enter the name, title, address, daytime telephone number, FAX number, and e-mail address

of the contact person for your organization. This must be a knowledgeable person in your

Va. Dept. of Taxation

Rev. (8/15/13)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6