Complete and use the button at the end to print for mailing.

HELP

SD EForm - 0839

V1

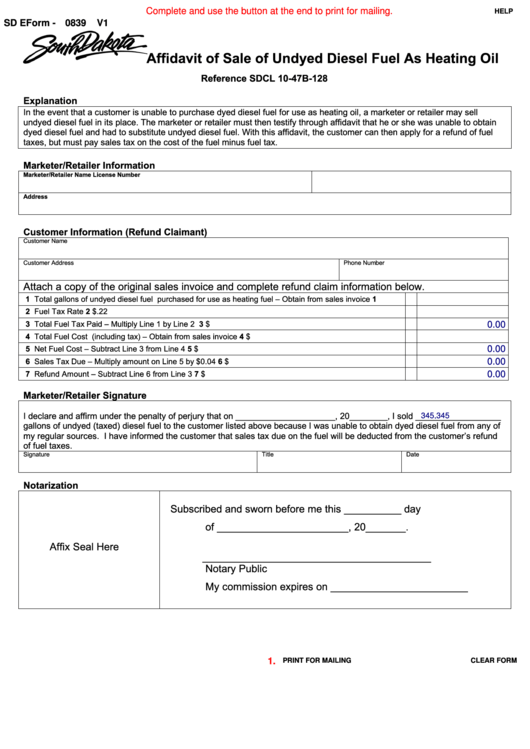

Affidavit of Sale of Undyed Diesel Fuel As Heating Oil

Reference SDCL 10-47B-128

Explanation

In the event that a customer is unable to purchase dyed diesel fuel for use as heating oil, a marketer or retailer may sell

undyed diesel fuel in its place. The marketer or retailer must then testify through affidavit that he or she was unable to obtain

dyed diesel fuel and had to substitute undyed diesel fuel. With this affidavit, the customer can then apply for a refund of fuel

taxes, but must pay sales tax on the cost of the fuel minus fuel tax.

Marketer/Retailer Information

Marketer/Retailer Name

License Number

Address

Customer Information (Refund Claimant)

Customer Name

Customer Address

Phone Number

Attach a copy of the original sales invoice and complete refund claim information below.

1 Total gallons of undyed diesel fuel purchased for use as heating fuel – Obtain from sales invoice

1

2 Fuel Tax Rate

2

$.22

3 Total Fuel Tax Paid – Multiply Line 1 by Line 2

3 $

0.00

4 Total Fuel Cost (including tax) – Obtain from sales invoice

4 $

5 $

5 Net Fuel Cost – Subtract Line 3 from Line 4

0.00

6 Sales Tax Due – Multiply amount on Line 5 by $0.04

6 $

0.00

7 Refund Amount – Subtract Line 6 from Line 3

7 $

0.00

Marketer/Retailer Signature

I declare and affirm under the penalty of perjury that on _____________________, 20________, I sold __________________

345,345

gallons of undyed (taxed) diesel fuel to the customer listed above because I was unable to obtain dyed diesel fuel from any of

my regular sources. I have informed the customer that sales tax due on the fuel will be deducted from the customer’s refund

of fuel taxes.

Signature

Title

Date

Notarization

Subscribed and sworn before me this __________ day

of _______________________, 20_______.

Affix Seal Here

________________________________________

Notary Public

My commission expires on ________________________

PRINT FOR MAILING

CLEAR FORM

1.

1

1