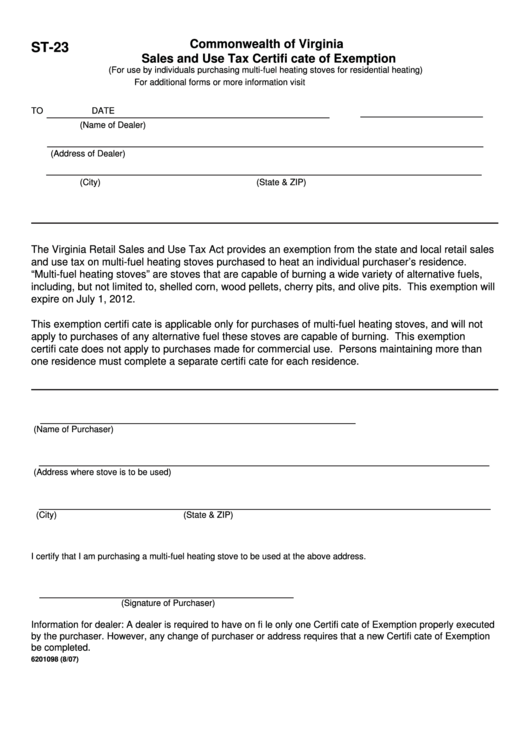

Commonwealth of Virginia

ST-23

Sales and Use Tax Certifi cate of Exemption

(For use by individuals purchasing multi-fuel heating stoves for residential heating)

For additional forms or more information visit

TO

DATE

(Name of Dealer)

(Address of Dealer)

(City)

(State & ZIP)

The Virginia Retail Sales and Use Tax Act provides an exemption from the state and local retail sales

and use tax on multi-fuel heating stoves purchased to heat an individual purchaser’s residence.

“Multi-fuel heating stoves” are stoves that are capable of burning a wide variety of alternative fuels,

including, but not limited to, shelled corn, wood pellets, cherry pits, and olive pits. This exemption will

expire on July 1, 2012.

This exemption certifi cate is applicable only for purchases of multi-fuel heating stoves, and will not

apply to purchases of any alternative fuel these stoves are capable of burning. This exemption

certifi cate does not apply to purchases made for commercial use. Persons maintaining more than

one residence must complete a separate certifi cate for each residence.

(Name of Purchaser)

(Address where stove is to be used)

(City)

(State & ZIP)

I certify that I am purchasing a multi-fuel heating stove to be used at the above address.

(Signature of Purchaser)

Information for dealer: A dealer is required to have on fi le only one Certifi cate of Exemption properly executed

by the purchaser. However, any change of purchaser or address requires that a new Certifi cate of Exemption

be completed.

6201098 (8/07)

1

1