Form Abc-800 - Kansas Liquor License Application Instructions

ADVERTISEMENT

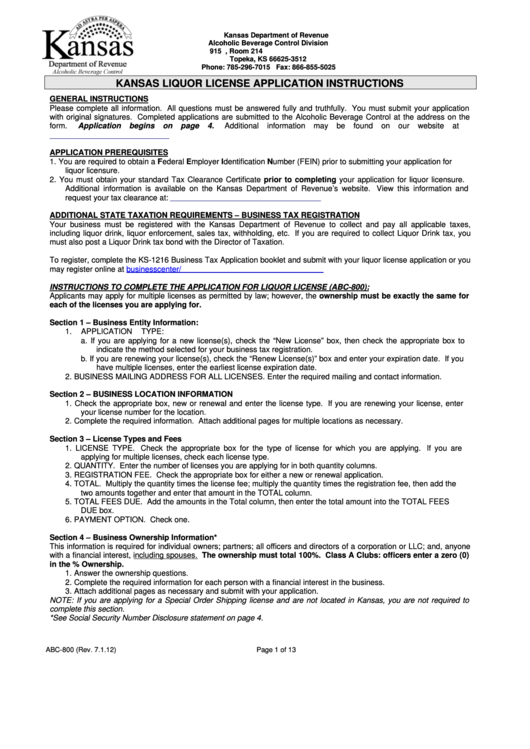

Kansas Department of Revenue

Alcoholic Beverage Control Division

915 S.W. Harrison Street, Room 214

Topeka, KS 66625-3512

Phone: 785-296-7015 Fax: 866-855-5025

KANSAS LIQUOR LICENSE APPLICATION INSTRUCTIONS

GENERAL INSTRUCTIONS

Please complete all information. All questions must be answered fully and truthfully. You must submit your application

with original signatures. Completed applications are submitted to the Alcoholic Beverage Control at the address on the

form.

Application

begins

on

page

4.

Additional

information

may

be

found

on

our

website

at

APPLICATION PREREQUISITES

1.

You are required to obtain a Federal Employer Identification Number (FEIN) prior to submitting your application for

liquor licensure.

2.

You must obtain your standard Tax Clearance Certificate prior to completing your application for liquor licensure.

Additional information is available on the Kansas Department of Revenue’s website. View this information and

request your tax clearance at:

ADDITIONAL STATE TAXATION REQUIREMENTS – BUSINESS TAX REGISTRATION

Your business must be registered with the Kansas Department of Revenue to collect and pay all applicable taxes,

including liquor drink, liquor enforcement, sales tax, withholding, etc. If you are required to collect Liquor Drink tax, you

must also post a Liquor Drink tax bond with the Director of Taxation.

To register, complete the KS-1216 Business Tax Application booklet and submit with your liquor license application or you

may register online at

https://

INSTRUCTIONS TO COMPLETE THE APPLICATION FOR LIQUOR LICENSE (ABC-800):

Applicants may apply for multiple licenses as permitted by law; however, the ownership must be exactly the same for

each of the licenses you are applying for.

Section 1 – Business Entity Information:

1.

APPLICATION TYPE:

a.

If you are applying for a new license(s), check the “New License” box, then check the appropriate box to

indicate the method selected for your business tax registration.

b.

If you are renewing your license(s), check the “Renew License(s)” box and enter your expiration date. If you

have multiple licenses, enter the earliest license expiration date.

2.

BUSINESS MAILING ADDRESS FOR ALL LICENSES. Enter the required mailing and contact information.

Section 2 – BUSINESS LOCATION INFORMATION

1.

Check the appropriate box, new or renewal and enter the license type. If you are renewing your license, enter

your license number for the location.

2.

Complete the required information. Attach additional pages for multiple locations as necessary.

Section 3 – License Types and Fees

1.

LICENSE TYPE. Check the appropriate box for the type of license for which you are applying. If you are

applying for multiple licenses, check each license type.

2.

QUANTITY. Enter the number of licenses you are applying for in both quantity columns.

3.

REGISTRATION FEE. Check the appropriate box for either a new or renewal application.

4.

TOTAL. Multiply the quantity times the license fee; multiply the quantity times the registration fee, then add the

two amounts together and enter that amount in the TOTAL column.

5.

TOTAL FEES DUE. Add the amounts in the Total column, then enter the total amount into the TOTAL FEES

DUE box.

6.

PAYMENT OPTION. Check one.

Section 4 – Business Ownership Information*

This information is required for individual owners; partners; all officers and directors of a corporation or LLC; and, anyone

with a financial interest, including spouses. The ownership must total 100%. Class A Clubs: officers enter a zero (0)

in the % Ownership.

1.

Answer the ownership questions.

2.

Complete the required information for each person with a financial interest in the business.

3.

Attach additional pages as necessary and submit with your application.

NOTE: If you are applying for a Special Order Shipping license and are not located in Kansas, you are not required to

complete this section.

*See Social Security Number Disclosure statement on page 4.

ABC-800 (Rev. 7.1.12)

Page 1 of 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13