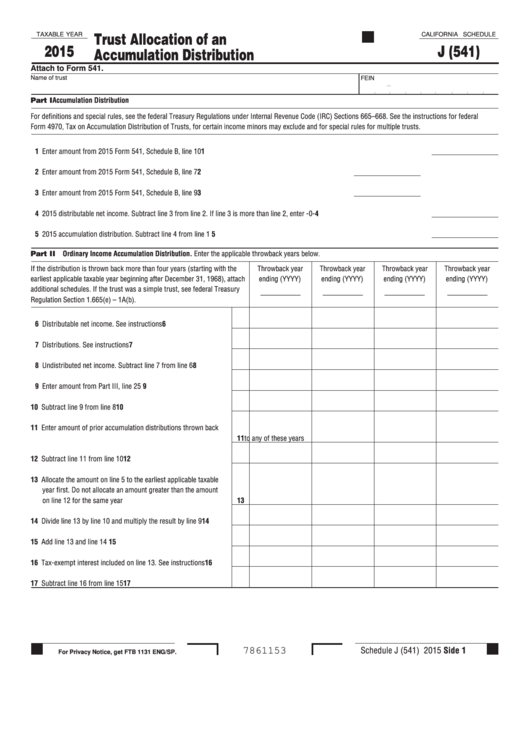

Trust Allocation of an

TAXABLE YEAR

CALIFORNIA SCHEDULE

2015

J (541)

Accumulation Distribution

Attach to Form 541.

Name of trust

FEIN

-

Part I Accumulation Distribution

For definitions and special rules, see the federal Treasury Regulations under Internal Revenue Code (IRC) Sections 665–668. See the instructions for federal

Form 4970, Tax on Accumulation Distribution of Trusts, for certain income minors may exclude and for special rules for multiple trusts.

1 Enter amount from 2015 Form 541, Schedule B, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Enter amount from 2015 Form 541, Schedule B, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Enter amount from 2015 Form 541, Schedule B, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 2015 distributable net income. Subtract line 3 from line 2. If line 3 is more than line 2, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 2015 accumulation distribution. Subtract line 4 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Part II Ordinary Income Accumulation Distribution. Enter the applicable throwback years below.

If the distribution is thrown back more than four years (starting with the

Throwback year

Throwback year

Throwback year

Throwback year

earliest applicable taxable year beginning after December 31, 1968), attach

ending (YYYY)

ending (YYYY)

ending (YYYY)

ending (YYYY)

additional schedules. If the trust was a simple trust, see federal Treasury

___________

___________

___________

___________

Regulation Section 1.665(e) – 1A(b).

6 Distributable net income. See instructions . . . . . . . . . . . . . . . . .

6

7 Distributions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Undistributed net income. Subtract line 7 from line 6. . . . . . . . .

8

9 Enter amount from Part III, line 25 . . . . . . . . . . . . . . . . . . . . . . .

9

10 Subtract line 9 from line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Enter amount of prior accumulation distributions thrown back

to any of these years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Subtract line 11 from line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Allocate the amount on line 5 to the earliest applicable taxable

year first. Do not allocate an amount greater than the amount

on line 12 for the same year . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Divide line 13 by line 10 and multiply the result by line 9 . . . . . .

14

15 Add line 13 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Tax-exempt interest included on line 13. See instructions . . . . .

16

17 Subtract line 16 from line 15. . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Schedule J (541) 2015 Side 1

7861153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2