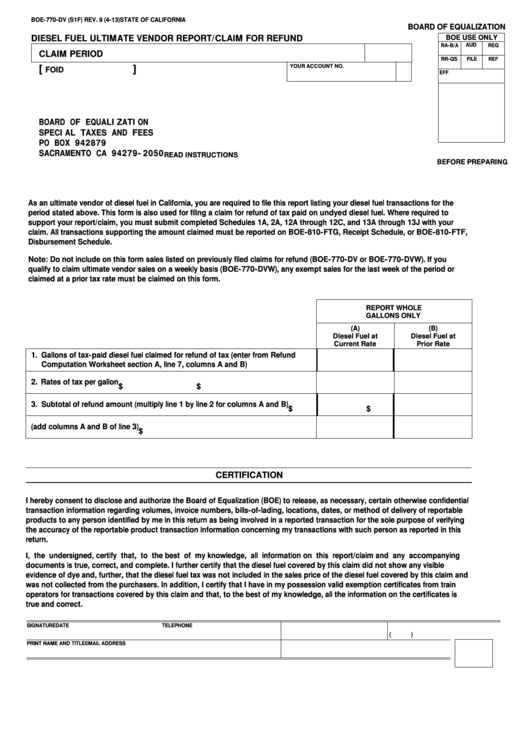

BOE-770-DV (S1F) REV. 9 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

DIESEL FUEL ULTIMATE VENDOR REPORT/CLAIM FOR REFUND

BOE USE ONLY

RA-B/A

AUD

REG

CLAIM PERIOD

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-2050

READ INSTRUCTIONS

BEFORE PREPARING

As an ultimate vendor of diesel fuel in California, you are required to file this report listing your diesel fuel transactions for the

period stated above. This form is also used for filing a claim for refund of tax paid on undyed diesel fuel. Where required to

support your report/claim, you must submit completed Schedules 1A, 2A, 12A through 12C, and 13A through 13J with your

claim. All transactions supporting the amount claimed must be reported on BOE-810-FTG, Receipt Schedule, or BOE-810-FTF,

Disbursement Schedule.

Note: Do not include on this form sales listed on previously filed claims for refund (BOE-770-DV or BOE-770-DVW). If you

qualify to claim ultimate vendor sales on a weekly basis (BOE-770-DVW), any exempt sales for the last week of the period or

claimed at a prior tax rate must be claimed on this form.

REPORT WHOLE

GALLONS ONLY

(A)

(B)

Diesel Fuel at

Diesel Fuel at

Current Rate

Prior Rate

1. Gallons of tax-paid diesel fuel claimed for refund of tax (enter from Refund

Computation Worksheet section A, line 7, columns A and B)

2. Rates of tax per gallon

$

$

3. Subtotal of refund amount (multiply line 1 by line 2 for columns A and B)

$

$

4. Amount of refund claimed (add columns A and B of line 3)

$

CERTIFICATION

I hereby consent to disclose and authorize the Board of Equalization (BOE) to release, as necessary, certain otherwise confidential

transaction information regarding volumes, invoice numbers, bills-of-lading, locations, dates, or method of delivery of reportable

products to any person identified by me in this return as being involved in a reported transaction for the sole purpose of verifying

the accuracy of the reportable product transaction information concerning my transactions with such person as reported in this

return.

I, the undersigned, certify that, to the best of my knowledge, all information on this report/claim and any accompanying

documents is true, correct, and complete. I further certify that the diesel fuel covered by this claim did not show any visible

evidence of dye and, further, that the diesel fuel tax was not included in the sales price of the diesel fuel covered by this claim and

was not collected from the purchasers. In addition, I certify that I have in my possession valid exemption certificates from train

operators for transactions covered by this claim and that, to the best of my knowledge, all the information on the certificates is

true and correct.

SIGNATURE

DATE

TELEPHONE

(

)

PRINT NAME AND TITLE

EMAIL ADDRESS

CONTINUED

1

1 2

2 3

3 4

4 5

5 6

6