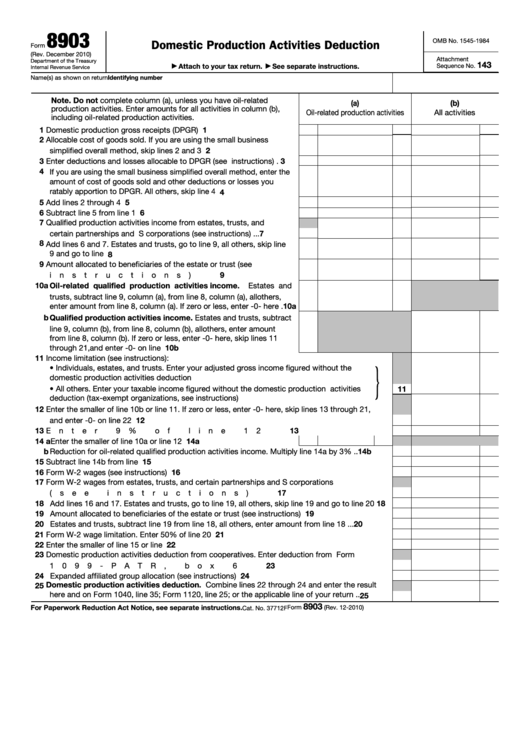

8903

OMB No. 1545-1984

Domestic Production Activities Deduction

Form

(Rev. December 2010)

Attachment

Department of the Treasury

143

Attach to your tax return.

See separate instructions.

Sequence No.

Internal Revenue Service

▶

▶

Identifying number

Name(s) as shown on return

Note. Do not complete column (a), unless you have oil-related

(a)

(b)

production activities. Enter amounts for all activities in column (b),

Oil-related production activities

All activities

including oil-related production activities.

1 Domestic production gross receipts (DPGR) .

.

.

.

.

.

.

.

1

2 Allocable cost of goods sold. If you are using the small business

2

simplified overall method, skip lines 2 and 3 .

.

.

.

.

.

.

.

3 Enter deductions and losses allocable to DPGR (see instructions) .

3

4 If you are using the small business simplified overall method, enter the

amount of cost of goods sold and other deductions or losses you

ratably apportion to DPGR. All others, skip line 4 .

.

.

.

.

.

.

4

5 Add lines 2 through 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 Subtract line 5 from line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7 Qualified production activities income from estates, trusts, and

certain partnerships and S corporations (see instructions)

.

.

.

7

8 Add lines 6 and 7. Estates and trusts, go to line 9, all others, skip line

9 and go to line 10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9 Amount allocated to beneficiaries of the estate or trust (see

instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10 a Oil-related qualified production activities income.

Estates and

trusts, subtract line 9, column (a), from line 8, column (a), all others,

enter amount from line 8, column (a). If zero or less, enter -0- here .

10a

b Qualified production activities income. Estates and trusts, subtract

line 9, column (b), from line 8, column (b), all others, enter amount

from line 8, column (b). If zero or less, enter -0- here, skip lines 11

through 21, and enter -0- on line 22 .

.

.

.

.

.

.

.

.

.

.

10b

11 Income limitation (see instructions):

}

• Individuals, estates, and trusts. Enter your adjusted gross income figured without the

domestic production activities deduction .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

• All others. Enter your taxable income figured without the domestic production activities

11

deduction (tax-exempt organizations, see instructions)

.

.

.

.

.

.

.

.

.

.

.

12 Enter the smaller of line 10b or line 11. If zero or less, enter -0- here, skip lines 13 through 21,

and enter -0- on line 22 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13 Enter 9% of line 12

13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14 a Enter the smaller of line 10a or line 12 .

.

.

.

.

.

.

.

.

.

14a

b Reduction for oil-related qualified production activities income. Multiply line 14a by 3%

.

.

14b

15 Subtract line 14b from line 13 .

15

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16 Form W-2 wages (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

17 Form W-2 wages from estates, trusts, and certain partnerships and S corporations

17

(see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18 Add lines 16 and 17. Estates and trusts, go to line 19, all others, skip line 19 and go to line 20

18

19 Amount allocated to beneficiaries of the estate or trust (see instructions)

.

.

.

.

.

.

.

19

20 Estates and trusts, subtract line 19 from line 18, all others, enter amount from line 18

.

.

.

20

21 Form W-2 wage limitation. Enter 50% of line 20 .

21

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

22 Enter the smaller of line 15 or line 21.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

22

23 Domestic production activities deduction from cooperatives. Enter deduction from Form

23

1099-PATR, box 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

24 Expanded affiliated group allocation (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

24

25 Domestic production activities deduction. Combine lines 22 through 24 and enter the result

here and on Form 1040, line 35; Form 1120, line 25; or the applicable line of your return

.

.

25

8903

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 12-2010)

Cat. No. 37712F

1

1