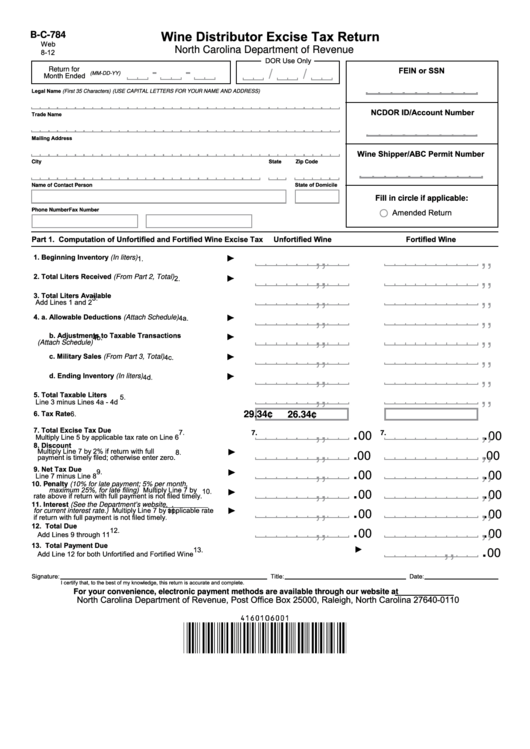

Wine Distributor Excise Tax Return

B-C-784

Web

North Carolina Department of Revenue

8-12

DOR Use Only

FEIN or SSN

Return for

Month Ended

(MM-DD-YY)

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

NCDOR ID/Account Number

Trade Name

Mailing Address

Wine Shipper/ABC Permit Number

State

City

Zip Code

State of Domicile

Name of Contact Person

Fill in circle if applicable:

Fax Number

Phone Number

Amended Return

Part 1. Computation of Unfortified and Fortified Wine Excise Tax

Unfortified Wine

Fortified Wine

,

,

,

,

1.

Beginning Inventory (In liters)

1.

,

,

,

,

2.

Total Liters Received (From Part 2, Total)

2.

,

,

,

,

3.

Total Liters Available

3.

Add Lines 1 and 2

,

,

,

,

4.

a.

Allowable Deductions (Attach Schedule)

4a.

,

,

,

,

b.

Adjustments to Taxable Transactions

4b.

(Attach Schedule)

,

,

,

,

c.

Military Sales (From Part 3, Total)

4c.

,

,

,

,

d.

Ending Inventory (In liters)

4d.

,

,

,

,

5.

Total Taxable Liters

5.

Line 3 minus Lines 4a - 4d

6.

Tax Rate

6.

26.34¢

29.34¢

.

.

,

,

,

,

7.

Total Excise Tax Due

7.

00

00

7.

7.

Multiply Line 5 by applicable tax rate on Line 6

.

.

8.

Discount

,

,

,

,

Multiply Line 7 by 2% if return with full

8.

00

00

payment is timely filed; otherwise enter zero.

.

.

,

,

,

,

9.

Net Tax Due

00

00

9.

Line 7 minus Line 8

.

.

10.

Penalty (10% for late payment; 5% per month,

,

,

,

,

maximum 25%, for late filing) Multiply Line 7 by

00

00

10.

rate above if return with full payment is not filed timely.

.

.

Interest (See the Department’s website, ,

11.

,

,

,

,

for current interest rate.) Multiply Line 7 by applicable rate

00

00

11.

if return with full payment is not filed timely.

.

.

,

,

,

,

12.

Total Due

00

00

12.

Add Lines 9 through 11

.

,

,

13.

Total Payment Due

13.

00

Add Line 12 for both Unfortified and Fortified Wine

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

For your convenience, electronic payment methods are available through our website at .

North Carolina Department of Revenue, Post Office Box 25000, Raleigh, North Carolina 27640-0110

1

1 2

2