INSTRUCTIONS

PURPOSE. The Payment and Authorization Agreement, Form 27D, is to be used when entering into a payment agreement

with the Nebraska Department of Revenue (Department). Your signature authorizes the Department to obtain agreed upon

payments through an electronic funds transfer (EFT) from your financial institution. With certain exceptions, this is the only

acceptable form of agreement the Department will allow for delinquent taxes.

WHO MUST FILE. This payment and authorization agreement must be completed by any taxpayer who wishes to enter into

a payment agreement with the Department, or by anyone who wishes to change or terminate an existing agreement.

WHEN AND WHERE TO FILE. This agreement must be received by the Department at least ten days prior to the due

date of the first installment. Send this agreement to: Nebraska Department of Revenue, P.O. Box 94609, Lincoln, Nebraska

68509‑4609. If you are in bankruptcy, do not file this form. Instead, call 402‑595‑2069 or 402‑595‑2070.

SPECIFIC INSTRUCTIONS. Business name and location address should be completed if this agreement is to resolve any

tax other than individual income taxes. Enter the name and address under which you do business.

Taxpayer name (name of corporation, partnership; if sole proprietorship or individual income tax, enter your full name) and

address must be completed by every taxpayer.

Complete your Nebraska Business Identification Number if you have been assigned one. Enter the federal identification

number if you have been assigned one. If no federal identification number is held, enter your social security number.

Check the appropriate boxes for the delinquent tax programs this agreement will resolve. Enter the total amount due, the

periods of delinquency, and the date interest has been computed through (refer to your most recent Balance Due Notice from

the Department).

SECTION I — INCOME

Complete this section and list the sources and amount of any income you or this business receives. Please list this income in

monthly figures. Attach additional sheets if necessary.

SECTION II — PAYMENT PROPOSAL

Enter the amount you will pay on a regular basis. These payments, if accepted, will be automatically deducted from your

account based on your authorization. Be sure the Department has this agreement at least ten days prior to your starting date

for these payments.

If the Department does not accept this proposal, a new proposal and a more detailed financial statement will be sent to you.

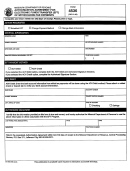

SECTION III — FINANCIAL INSTITUTION ACCOUNT INFORMATION

(See diagrams in next column.)

Enter: (1) the name and address of the financial institution from which you want these payments deducted; (2) the exact name

shown on your account; (3) the account number from which these payments will be transferred; and (4) the routing transit

number. Also check the appropriate box for the type of account — checking or savings.

0000

Tom and Mary Somebody

DEPOSIT TICKET

2

2

5432 Sameday Lane

Tom and Mary Somebody

20

Anywhere, NE 68000

5432 Sameday Lane

Pay to

Anywhere, NE 68000

20

DATE

the order of

$

1

Dollars

1

NET DEPOSIT

Our Financial Institution

Our Financial Institution

P.O. Box 000, Anywhere, NE 68000

P.O. Box 000, Anywhere, NE 68000

000000000 000 0000 0000

000000000 000 0000 0000

3

3

4

4

000000000 000 0000

000000000 000 0000

Attach a VOIDED check for this checking account or a VOIDED deposit slip for this savings account.

SECTION IV — AUTHORIZATION

This completed and signed form authorizes the Department to make automatic withdrawals from your checking or savings

account. An account owner, or other individuals authorized to make withdrawals, MUST sign this form.

PAYMENT DATE. The financial institution will transfer the amount of your payment automatically on the date specified in

Section II. However, because these transactions are not processed on Saturdays, Sundays, or financial institution holidays,

your actual payment date may be delayed to the next business day.

If this agreement will be used to pay more than one type of tax, or for more than one tax year, there will be occasions when

this will appear as two withdrawals on the same day. They will still total the amount of payment as specified in Section II.

If your financial institution notifies you that its ownership has changed, please contact the Department. A new Form 27D

may be needed.

If you make any additional payments, or have had refunds transferred to this balance, you must notify the agent

referenced on this form to discuss how this agreement will be affected.

IMPORTANT NOTICE: You will be assessed a $20 fee for any EFT payment from your account that is returned without

payment by your financial institution.

1

1 2

2