Instructions For Form Ftb 3506 - Child And Dependent Care Expenses Credit

ADVERTISEMENT

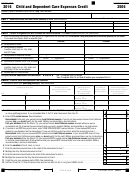

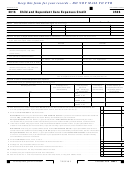

Instructions for Form FTB 3506

Child and Dependent Care Expenses Credit

General Information

D Qualifying Person Defined

Attach the completed form FTB 3506, Child and Dependent Care Expenses

Rules for Most People

Credit, to your Form 540, California Resident Income Tax Return, or Long

A qualifying person is:

Form 540NR, California Nonresident or Part-Year Resident Income Tax

Return, if you claim the child and dependent care expenses credit.

1. A child under age 13 who meets the requirements to be your dependent

as a Qualifying Child. A child who turned 13 during the year qualifies

For taxable years beginning on and after January 1, 2011 the child and

only for the part of the year when he or she was 12 years old.

dependent care expenses credit is nonrefundable.

2. Your spouse/RDP who was physically or mentally incapable of self-care.

Registered Domestic Partners (RDP) – For purposes of California income

3. Any person who was physically or mentally incapable of self-care and

tax, references to a spouse, husband, or wife also refer to a California RDP,

either:

unless otherwise specified. When we use the initials RDP, they refer to both a

a. Was your dependent.

California registered domestic “partner” and a California registered domestic

b. Would have been your dependent except that:

“partnership,” as applicable. For more information on RDPs, get FTB Pub. 737,

i. He or she received gross income of $3,900 or more.

Tax Information for Registered Domestic Partners.

ii. He or she filed a joint tax return.

iii. You, or your spouse/RDP if filing a joint tax return, could be

A Purpose

claimed as a dependent on someone else’s 2013 tax return.

You may qualify to claim the 2013 credit for child and dependent care

Qualifying Child

expenses, if you (and your spouse/RDP) paid someone in California to care

A Qualifying Child is a child who meets all of the following tests:

for your child or other qualifying person while you worked or looked for

employment. You must have earned income to do so. If you qualify to claim

• Relationship Test – The child must be your son, daughter, stepchild,

the credit, use form FTB 3506 to figure the amount of your credit.

adopted child, eligible foster child, brother, sister, half-brother, half-sister,

stepbrother, stepsister, or a descendant of one of these. An adopted child

If you received dependent care benefits for 2013 but do not qualify to claim

includes a child who has been lawfully placed with you for legal adoption

the credit, you are not required to complete form FTB 3506. For additional

even if the adoption is not yet final. An eligible foster child must be

definitions, requirements, and instructions, get federal Form 2441, Child and

placed with you by an authorized placement agency or by a court.

Dependent Care Expenses.

• Age Test – For the purposes of qualifying for the Child and Dependent

B Differences in California and Federal Law

Care Expenses Credit, the child must be under 13.

• Residency Test – The child must live with you for more than half the

The differences between California and federal law are as follows:

year.

• Support Test – The child must not have provided more than half of his or

• California allows this credit only for care provided in California.

her own support.

• If you were a nonresident, you must have earned wages from working in

• Joint Return Test – The child must not have filed a joint federal or state

California or earned self-employment income from California business

income tax return with his or her spouse/RDP.

activities.

• Citizenship Test – The child must be a citizen or national of the U.S. or a

• The California credit is a percentage of the federal credit.

resident of the U.S., Canada, or Mexico.

• RDPs may file a joint California return and claim this credit. For more

information, get FTB Pub. 737.

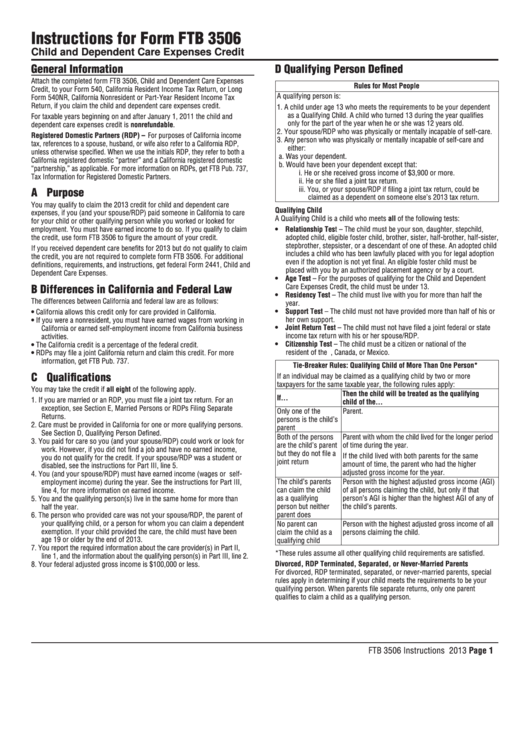

Tie-Breaker Rules: Qualifying Child of More Than One Person*

C Qualifications

If an individual may be claimed as a qualifying child by two or more

taxpayers for the same taxable year, the following rules apply:

You may take the credit if all eight of the following apply.

Then the child will be treated as the qualifying

If…

1. If you are married or an RDP, you must file a joint tax return. For an

child of the…

exception, see Section E, Married Persons or RDPs Filing Separate

Only one of the

Parent.

Returns.

persons is the child’s

2. Care must be provided in California for one or more qualifying persons.

parent

See Section D, Qualifying Person Defined.

Both of the persons

Parent with whom the child lived for the longer period

3. You paid for care so you (and your spouse/RDP) could work or look for

are the child’s parent

of time during the year.

work. However, if you did not find a job and have no earned income,

but they do not file a

If the child lived with both parents for the same

you do not qualify for the credit. If your spouse/RDP was a student or

joint return

amount of time, the parent who had the higher

disabled, see the instructions for Part III, line 5.

adjusted gross income for the year.

4. You (and your spouse/RDP) must have earned income (wages or self-

employment income) during the year. See the instructions for Part III,

The child’s parents

Person with the highest adjusted gross income (AGI)

can claim the child

of all persons claiming the child, but only if that

line 4, for more information on earned income.

as a qualifying

person’s AGI is higher than the highest AGI of any of

5. You and the qualifying person(s) live in the same home for more than

person but neither

the child’s parents.

half the year.

parent does

6. The person who provided care was not your spouse/RDP, the parent of

your qualifying child, or a person for whom you can claim a dependent

No parent can

Person with the highest adjusted gross income of all

exemption. If your child provided the care, the child must have been

claim the child as a

persons claiming the child.

age 19 or older by the end of 2013.

qualifying child

7. You report the required information about the care provider(s) in Part II,

*These rules assume all other qualifying child requirements are satisfied.

line 1, and the information about the qualifying person(s) in Part III, line 2.

8. Your federal adjusted gross income is $100,000 or less.

Divorced, RDP Terminated, Separated, or Never-Married Parents

For divorced, RDP terminated, separated, or never-married parents, special

rules apply in determining if your child meets the requirements to be your

qualifying person. When parents file separate returns, only one parent

qualifies to claim a child as a qualifying person.

FTB 3506 Instructions 2013 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4