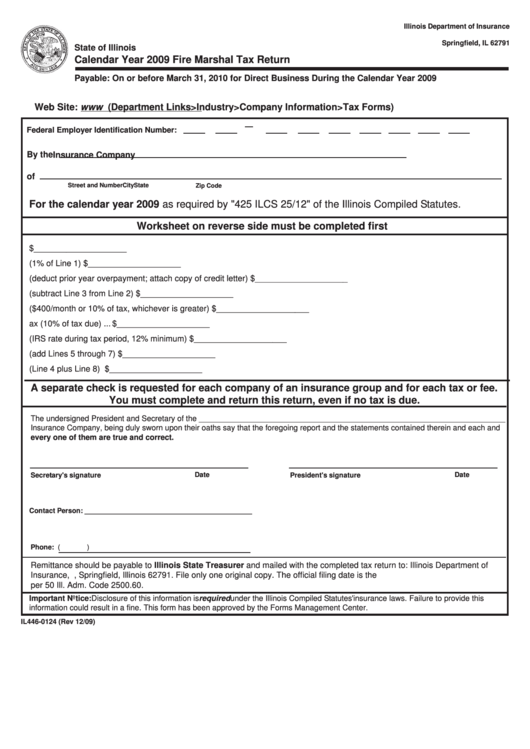

Form Il446-0124 - Fire Marshal Tax Return - 2009

ADVERTISEMENT

Illinois Department of Insurance

P.O. Box 7087

Springfield, IL 62791

State of Illinois

Calendar Year 2009 Fire Marshal Tax Return

Payable: On or before March 31, 2010 for Direct Business During the Calendar Year 2009

Web Site: (Department Links>Industry>Company Information>Tax Forms)

Federal Employer Identification Number:

By the

Insurance Company

of

Street and Number

City

State

Zip Code

For the calendar year 2009 as required by "425 ILCS 25/12" of the Illinois Compiled Statutes.

Worksheet on reverse side must be completed first

1.

Net amount of taxable premiums from Line 14 on back .................................................................. $____________________

2.

Tax due (1% of Line 1) ..................................................................................................................... $____________________

3.

Fire Marshal Tax Credit (deduct prior year overpayment; attach copy of credit letter) .................... $____________________

4.

Amount of tax paid (subtract Line 3 from Line 2) ............................................................................. $____________________

5.

Penalty for failure to file tax return ($400/month or 10% of tax, whichever is greater) .................... $____________________

6.

Penalty for failure to pay tax (10% of tax due) ................................................................................. $____________________

7.

Interest on tax paid after due date (IRS rate during tax period, 12% minimum) .............................. $____________________

8.

Total penalty and interest (add Lines 5 through 7) ........................................................................... $____________________

9.

Balance due (Line 4 plus Line 8) ..................................................................................................... $____________________

A separate check is requested for each company of an insurance group and for each tax or fee.

You must complete and return this return, even if no tax is due.

The undersigned President and Secretary of the ______________________________________________________________________

Insurance Company, being duly sworn upon their oaths say that the foregoing report and the statements contained therein and each and

every one of them are true and correct.

Date

Date

Secretary's signature

President's signature

Contact Person: ___________________________________________

Phone: (

)

Remittance should be payable to Illinois State Treasurer and mailed with the completed tax return to: Illinois Department of

Insurance, P.O. Box 7087, Springfield, Illinois 62791. File only one original copy. The official filing date is the U.S. Postal date

per 50 Ill. Adm. Code 2500.60.

Important Notice: Disclosure of this information is required under the Illinois Compiled Statutes' insurance laws. Failure to provide this

information could result in a fine. This form has been approved by the Forms Management Center.

IL446-0124 (Rev 12/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1