Form Ct-33-A/att - Schedules A, B, C, D, And E - Attachment To Form Ct-33-A - Life Insurance Corporation Combined Franchise Tax Return - 2014

ADVERTISEMENT

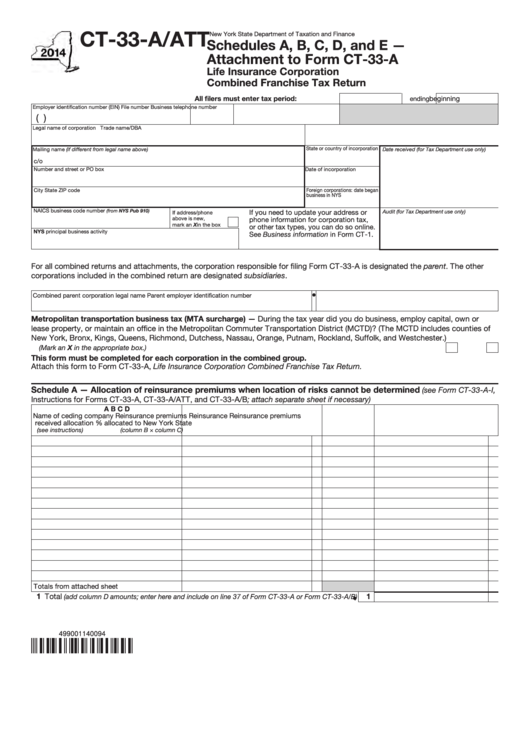

CT-33-A/ATT

New York State Department of Taxation and Finance

Schedules A, B, C, D, and E —

Attachment to Form CT-33-A

Life Insurance Corporation

Combined Franchise Tax Return

All filers must enter tax period:

beginning

ending

Employer identification number (EIN)

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

State or country of incorporation

Mailing name (if different from legal name above)

Date received (for Tax Department use only)

c/o

Number and street or PO box

Date of incorporation

City

State

ZIP code

Foreign corporations: date began

business in NYS

NAICS business code number

(from NYS Pub 910)

If you need to update your address or

Audit (for Tax Department use only)

If address/phone

above is new,

phone information for corporation tax,

mark an X in the box

or other tax types, you can do so online.

NYS principal business activity

See Business information in Form CT-1.

For all combined returns and attachments, the corporation responsible for filing Form CT-33-A is designated the parent. The other

corporations included in the combined return are designated subsidiaries.

Combined parent corporation legal name

Parent employer identification number

Metropolitan transportation business tax (MTA surcharge) — During the tax year did you do business, employ capital, own or

lease property, or maintain an office in the Metropolitan Commuter Transportation District (MCTD)? (The MCTD includes counties of

New York, Bronx, Kings, Queens, Richmond, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester.)

................................................................................................................................ Yes

No

(Mark an X in the appropriate box.)

This form must be completed for each corporation in the combined group.

Attach this form to Form CT-33-A, Life Insurance Corporation Combined Franchise Tax Return.

Schedule A — Allocation of reinsurance premiums when location of risks cannot be determined

(see Form CT-33-A-I,

Instructions for Forms CT-33-A, CT-33-A/ATT, and CT-33-A/B; attach separate sheet if necessary)

A

B

C

D

Name of ceding company

Reinsurance premiums

Reinsurance

Reinsurance premiums

received

allocation %

allocated to New York State

(see instructions)

(column B × column C)

Totals from attached sheet ................................

1 Total

1

(add column D amounts; enter here and include on line 37 of Form CT-33-A or Form CT-33-A/B)

499001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3