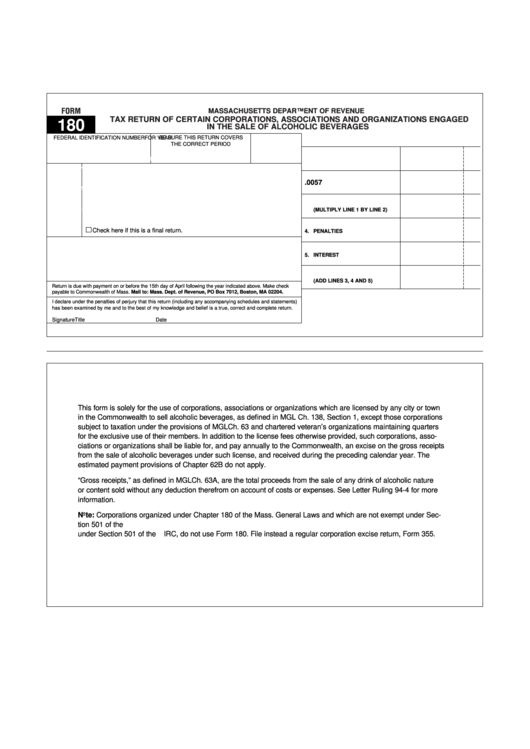

FORM

MASSACHUSETTS DEPARTMENT OF REVENUE

TAX RETURN OF CERTAIN CORPORATIONS, ASSOCIATIONS AND ORGANIZATIONS ENGAGED

180

IN THE SALE OF ALCOHOLIC BEVERAGES

FEDERAL IDENTIFICATION NUMBER

BE SURE THIS RETURN COVERS

FOR YEAR

THE CORRECT PERIOD

IF INCORRECT, SEE INSTRUCTIONS. DO NOT ALTER.

1. GROSS RECEIPTS

BUSINESS NAME

.0057

2. TAX RATE

BUSINESS ADDRESS

3. TAX DUE

CITY/TOWN

STATE

ZIP

(MULTIPLY LINE 1 BY LINE 2)

Check here if this is a final return.

4. PENALTIES

5. INTEREST

6. TOTAL AMOUNT DUE

(ADD LINES 3, 4 AND 5)

Return is due with payment on or before the 15th day of April following the year indicated above. Make check

payable to Commonwealth of Mass. Mail to: Mass. Dept. of Revenue, PO Box 7012, Boston, MA 02204.

I declare under the penalties of perjury that this return (including any accompanying schedules and statements)

has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Signature

Title

Date

This form is solely for the use of corporations, associations or organizations which are licensed by any city or town

in the Commonwealth to sell alcoholic beverages, as defined in MGL Ch. 138, Section 1, except those corporations

subject to taxation under the provisions of MGL Ch. 63 and chartered veteran’s organizations maintaining quarters

for the exclusive use of their members. In addition to the license fees otherwise provided, such corporations, asso-

ciations or organizations shall be liable for, and pay annually to the Commonwealth, an excise on the gross receipts

from the sale of alcoholic beverages under such license, and received during the preceding calendar year. The

estimated payment provisions of Chapter 62B do not apply.

“Gross receipts,” as defined in MGL Ch. 63A, are the total proceeds from the sale of any drink of alcoholic nature

or content sold without any deduction therefrom on account of costs or expenses. See Letter Ruling 94-4 for more

information.

Note: Corporations organized under Chapter 180 of the Mass. General Laws and which are not exempt under Sec-

tion 501 of the U.S. Internal Revenue Code are subject to taxation under Chapter 63. If the corporation is not exempt

under Section 501 of the U.S. IRC, do not use Form 180. File instead a regular corporation excise return, Form 355.

1

1