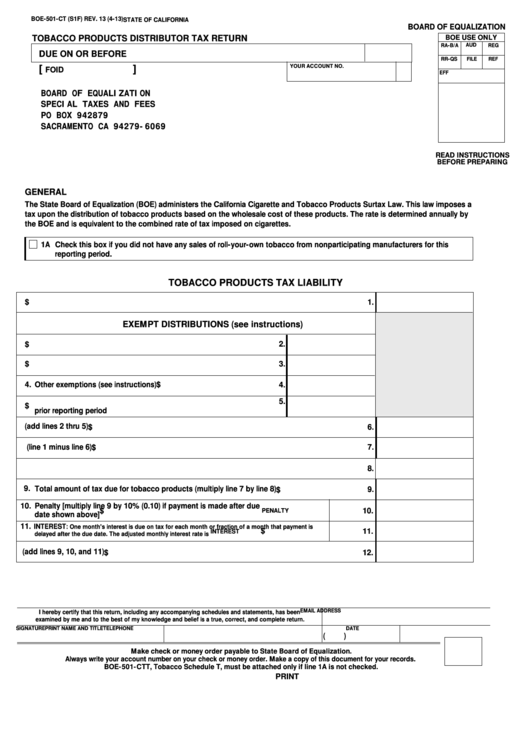

BOE-501-CT (S1F) REV. 13 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

TOBACCO PRODUCTS DISTRIBUTOR TAX RETURN

BOE USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-6069

READ INSTRUCTIONS

BEFORE PREPARING

GENERAL

The State Board of Equalization (BOE) administers the California Cigarette and Tobacco Products Surtax Law. This law imposes a

tax upon the distribution of tobacco products based on the wholesale cost of these products. The rate is determined annually by

the BOE and is equivalent to the combined rate of tax imposed on cigarettes.

1A Check this box if you did not have any sales of roll-your-own tobacco from nonparticipating manufacturers for this

reporting period.

TOBACCO PRODUCTS TAX LIABILITY

1. Wholesale cost of all tobacco products distributed

1.

$

EXEMPT DISTRIBUTIONS (see instructions)

2. Interstate or foreign commerce

2.

$

3. Interstate or foreign passenger common carriers

3.

$

4. Other exemptions (see instructions)

$

4.

5.

5. Credit on returned tobacco products where you reported tax for a

$

prior reporting period

6. Total exempt distributions (add lines 2 thru 5)

6.

$

7. Taxable distributions (line 1 minus line 6)

7.

$

8. Tax rate

8.

9. Total amount of tax due for tobacco products (multiply line 7 by line 8)

9.

$

10. Penalty [multiply line 9 by 10% (0.10) if payment is made after due

10.

$

PENALTY

date shown above]

11.

INTEREST:

One month's interest is due on tax for each month or fraction of a month that payment is

11.

$

INTEREST

delayed after the due date. The adjusted monthly interest rate is

12. TOTAL AMOUNT DUE AND PAYABLE (add lines 9, 10, and 11)

12.

$

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

BOE-501-CTT, Tobacco Schedule T, must be attached only if line 1A is not checked.

CLEAR

PRINT

1

1 2

2 3

3