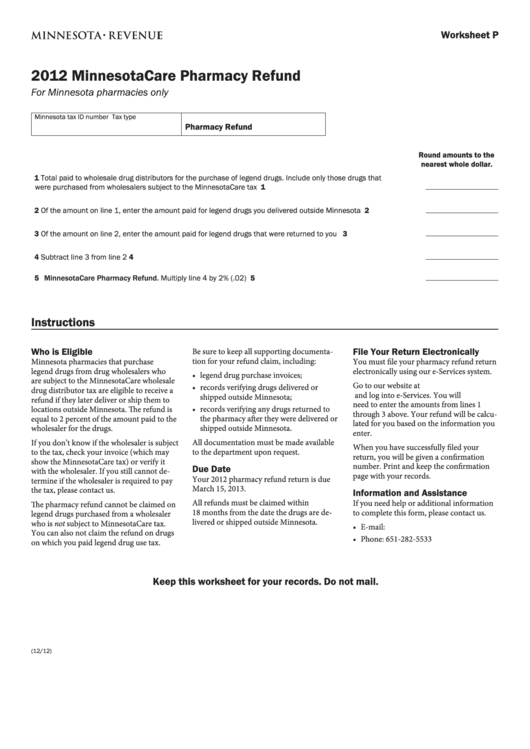

Worksheet P

2012 MinnesotaCare Pharmacy Refund

For Minnesota pharmacies only

Minnesota tax ID number

Tax type

Pharmacy Refund

Round amounts to the

nearest whole dollar.

1 Total paid to wholesale drug distributors for the purchase of legend drugs. Include only those drugs that

were purchased from wholesalers subject to the MinnesotaCare tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Of the amount on line 1, enter the amount paid for legend drugs you delivered outside Minnesota . . . . . . . . . . . . 2

3 Of the amount on line 2, enter the amount paid for legend drugs that were returned to you . . . . . . . . . . . . . . . . . . 3

4 Subtract line 3 from line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 MinnesotaCare Pharmacy Refund. Multiply line 4 by 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Instructions

Who is Eligible

File Your Return Electronically

Be sure to keep all supporting documenta-

tion for your refund claim, including:

Minnesota pharmacies that purchase

You must file your pharmacy refund return

legend drugs from drug wholesalers who

electronically using our e-Services system.

• legend drug purchase invoices;

are subject to the MinnesotaCare wholesale

Go to our website at

• records verifying drugs delivered or

drug distributor tax are eligible to receive a

mn.us and log into e-Services. You will

shipped outside Minnesota;

refund if they later deliver or ship them to

need to enter the amounts from lines 1

locations outside Minnesota. The refund is

• records verifying any drugs returned to

through 3 above. Your refund will be calcu-

equal to 2 percent of the amount paid to the

the pharmacy after they were delivered or

lated for you based on the information you

wholesaler for the drugs.

shipped outside Minnesota.

enter.

All documentation must be made available

If you don’t know if the wholesaler is subject

When you have successfully filed your

to the tax, check your invoice (which may

to the department upon request.

return, you will be given a confirmation

show the MinnesotaCare tax) or verify it

number. Print and keep the confirmation

Due Date

with the wholesaler. If you still cannot de-

page with your records.

Your 2012 pharmacy refund return is due

termine if the wholesaler is required to pay

March 15, 2013.

the tax, please contact us.

Information and Assistance

All refunds must be claimed within

If you need help or additional information

The pharmacy refund cannot be claimed on

18 months from the date the drugs are de-

to complete this form, please contact us.

legend drugs purchased from a wholesaler

livered or shipped outside Minnesota.

who is not subject to MinnesotaCare tax.

• E-mail: MinnesotaCare.tax@state.mn.us

You can also not claim the refund on drugs

• Phone: 651-282-5533

on which you paid legend drug use tax.

Keep this worksheet for your records. Do not mail.

(12/12)

1

1