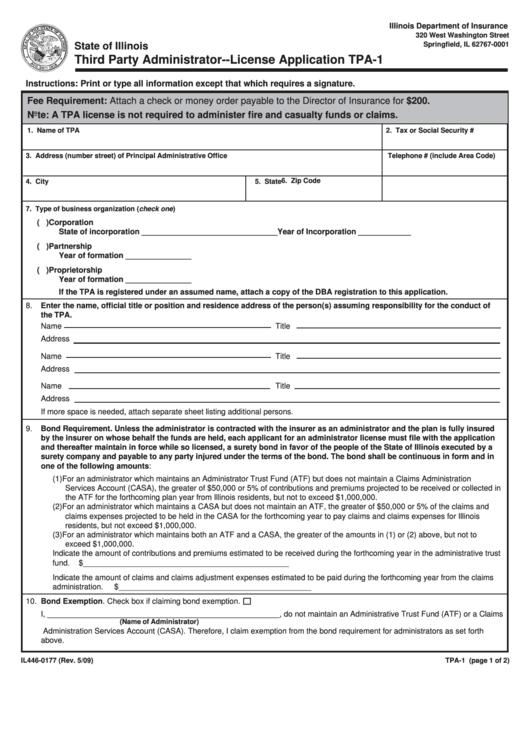

Form Il446-0177 - Third Party Administrator- License Application Tpa-1

ADVERTISEMENT

Illinois Department of Insurance

320 West Washington Street

Springfield, IL 62767-0001

State of Illinois

Third Party Administrator--License Application TPA-1

Instructions: Print or type all information except that which requires a signature.

Fee Requirement: Attach a check or money order payable to the Director of Insurance for $200.

Note: A TPA license is not required to administer fire and casualty funds or claims.

1. Name of TPA

2. Tax or Social Security #

3. Address (number street) of Principal Administrative Office

Telephone # (include Area Code)

6. Zip Code

4. City

5. State

7. Type of business organization (check one)

( )

Corporation

State of incorporation _______________________________

Year of Incorporation ____________

( )

Partnership

Year of formation _______________

( )

Proprietorship

Year of formation _______________

If the TPA is registered under an assumed name, attach a copy of the DBA registration to this application.

8.

Enter the name, official title or position and residence address of the person(s) assuming responsibility for the conduct of

the TPA.

Name

Title

Address

Name

Title

Address

Name

Title

Address

If more space is needed, attach separate sheet listing additional persons.

9.

Bond Requirement. Unless the administrator is contracted with the insurer as an administrator and the plan is fully insured

by the insurer on whose behalf the funds are held, each applicant for an administrator license must file with the application

and thereafter maintain in force while so licensed, a surety bond in favor of the people of the State of Illinois executed by a

surety company and payable to any party injured under the terms of the bond. The bond shall be continuous in form and in

one of the following amounts:

(1) For an administrator which maintains an Administrator Trust Fund (ATF) but does not maintain a Claims Administration

Services Account (CASA), the greater of $50,000 or 5% of contributions and premiums projected to be received or collected in

the ATF for the forthcoming plan year from Illinois residents, but not to exceed $1,000,000.

(2) For an administrator which maintains a CASA but does not maintain an ATF, the greater of $50,000 or 5% of the claims and

claims expenses projected to be held in the CASA for the forthcoming year to pay claims and claims expenses for Illinois

residents, but not exceed $1,000,000.

(3) For an administrator which maintains both an ATF and a CASA, the greater of the amounts in (1) or (2) above, but not to

exceed $1,000,000.

Indicate the amount of contributions and premiums estimated to be received during the forthcoming year in the administrative trust

fund.

$_______________________________________________

Indicate the amount of claims and claims adjustment expenses estimated to be paid during the forthcoming year from the claims

administration.

$____________________________________________

10. Bond Exemption. Check box if claiming bond exemption.

I, _____________________________________________________, do not maintain an Administrative Trust Fund (ATF) or a Claims

(Name of Administrator)

Administration Services Account (CASA). Therefore, I claim exemption from the bond requirement for administrators as set forth

above.

IL446-0177 (Rev. 5/09)

TPA-1 (page 1 of 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2