Residence Questionnaire - Maine Revenue Services

ADVERTISEMENT

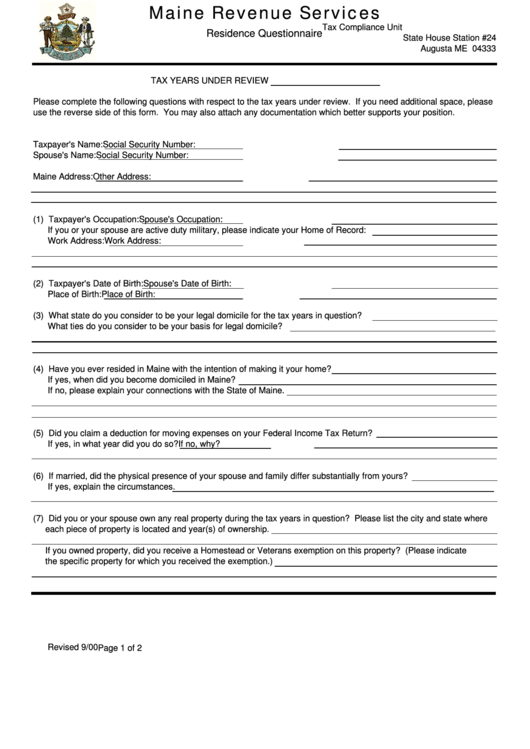

Maine Revenue Services

Tax Compliance Unit

Residence Questionnaire

State House Station #24

Augusta ME 04333

TAX YEARS UNDER REVIEW

Please complete the following questions with respect to the tax years under review. If you need additional space, please

use the reverse side of this form. You may also attach any documentation which better supports your position.

Taxpayer's Name:

Social Security Number:

Spouse's Name:

Social Security Number:

Maine Address:

Other Address:

(1) Taxpayer's Occupation:

Spouse's Occupation:

If you or your spouse are active duty military, please indicate your Home of Record:

Work Address:

Work Address:

(2) Taxpayer's Date of Birth:

Spouse's Date of Birth:

Place of Birth:

Place of Birth:

(3) What state do you consider to be your legal domicile for the tax years in question?

What ties do you consider to be your basis for legal domicile?

(4) Have you ever resided in Maine with the intention of making it your home?

If yes, when did you become domiciled in Maine?

If no, please explain your connections with the State of Maine.

(5) Did you claim a deduction for moving expenses on your Federal Income Tax Return?

If yes, in what year did you do so?

If no, why?

(6) If married, did the physical presence of your spouse and family differ substantially from yours?

If yes, explain the circumstances.

(7) Did you or your spouse own any real property during the tax years in question? Please list the city and state where

each piece of property is located and year(s) of ownership.

If you owned property, did you receive a Homestead or Veterans exemption on this property? (Please indicate

the specific property for which you received the exemption.)

Revised 9/00

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2