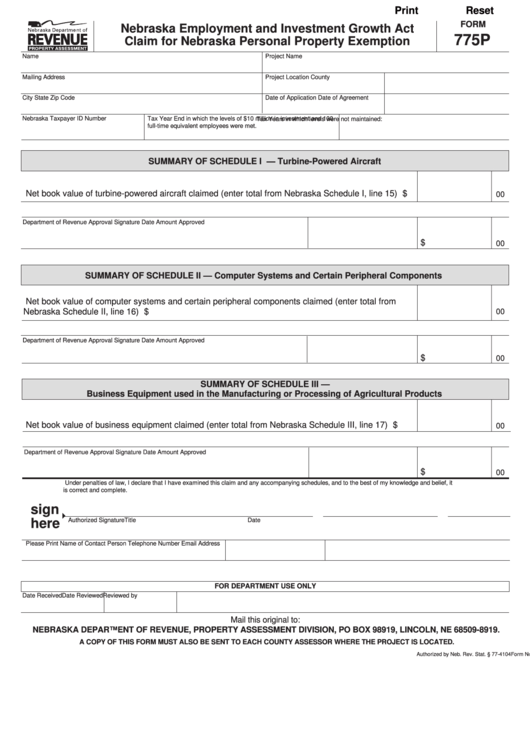

Print

Reset

FORM

Nebraska Employment and Investment Growth Act

775P

Claim for Nebraska Personal Property Exemption

Name

Project Name

Mailing Address

Project Location

County

City

State

Zip Code

Date of Application

Date of Agreement

Nebraska Taxpayer ID Number

Tax Year End in which the levels of $10 million in investment and 100

Tax Years in which levels were not maintained:

full-time equivalent employees were met.

SUMMARY OF SCHEDULE I — Turbine-Powered Aircraft

Net book value of turbine-powered aircraft claimed (enter total from Nebraska Schedule I, line 15) ....... $

00

Department of Revenue Approval Signature

Date

Amount Approved

$

00

SUMMARY OF SCHEDULE II — Computer Systems and Certain Peripheral Components

Net book value of computer systems and certain peripheral components claimed (enter total from

Nebraska Schedule II, line 16) .................................................................................................................. $

00

Department of Revenue Approval Signature

Date

Amount Approved

$

00

SUMMARY OF SCHEDULE III —

Business Equipment used in the Manufacturing or Processing of Agricultural Products

Net book value of business equipment claimed (enter total from Nebraska Schedule III, line 17) ........... $

00

Department of Revenue Approval Signature

Date

Amount Approved

$

00

Under penalties of law, I declare that I have examined this claim and any accompanying schedules, and to the best of my knowledge and belief, it

is correct and complete.

sign

Authorized Signature

Title

Date

here

Please Print Name of Contact Person

Telephone Number

Email Address

FOR DEPARTMENT USE ONLY

Date Received

Date Reviewed

Reviewed by

Mail this original to:

NEBRASKA DEPARTMENT OF REVENUE, PROPERTY ASSESSMENT DIVISION, PO BOX 98919, LINCOLN, NE 68509-8919.

A COPY OF THIS FORM MUST ALSO BE SENT TO EACH COUNTY ASSESSOR WHERE THE PROJECT IS LOCATED.

Form No. 96-307-2011 Rev. 5-2012

Authorized by Neb. Rev. Stat. § 77-4104

1

1 2

2