BOE-531-A2 (S6) REV. 15 (7-13)

INSTRUCTIONS FOR COMPLETING BOE-531-A2, SCHEDULE A2 - Long Form

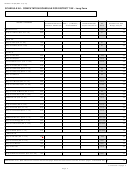

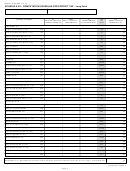

COMPUTATION SCHEDULE FOR DISTRICT TAX

Step 1. Enter taxable sales from return.

Step 4. Enter district adjustments.

A1. Enter the amount from line 16 on the front of your Sales and

A6/A7. If you have adjustments for one or more districts, enter

amounts in this column. Entries in this column will increase or

Use Tax Return.

decrease the amount of tax distributed to districts for which

Step 2. Calculate transactions subject to district tax.

you have adjustments.

A2/A3. Enter sales of items (excluding vehicles, vessels or

Enter the following adjustments by district. (You do not need an

aircraft) delivered and used (1) at a location where no district

entry in column A5 to enter an adjustment in column A6/A7.)

tax is in effect or (2) in a district where you are not "engaged in

Note: Please attach an explanation of any adjustments to your

business" and did not collect the district tax. (See publication

Schedule A2.

105, District Taxes and Delivered Sales, available on our website

at , for a definition of "engaged in business.")

The following examples are positive (+) adjustments:

Claimed deductions that were taxed at a rate lower than the

A4. Subtract A2/A3 from A1. Enter the result on A4.

current rate. If you claimed a deduction on the front of your

If your line A4 is $0.00 and you have no adjustments for prior

return for bad debts, tax-paid purchases resold, returned

periods, you are finished with your Schedule A2. Enter $0.00 on

merchandise, or cash discounts, and if those transactions

line 18 of your return. You may want to call our Taxpayer

were originally taxed at a rate lower than the current rate,

Information Section at 1-800-400-7115 to see if you qualify for

add the total for those transactions (by district).

filing our EZ return (BOE-401-EZ).

Items you purchased without paying district tax. If you paid

Step 3. Report transactions by district.

state and local sales tax on a purchase, but not district tax,

A5. Using the total from line A4, list your transactions by the

and if you made a taxable use of the item in a tax district,

correct districts.

add the price of the item for that district.

DO NOT report the same transactions in both a city and county

Amounts collected for a discontinued district. If you

district. The tax rate for city districts includes all county district

collected taxes for a district that has been discontinued and

tax. Report them for the city only.

have not paid those taxes to the Board of Equalization, add

the amounts on which you collected those taxes. Do not

Example: Your line A4 total is $19,000, which represents:

enter those amounts on line A5. If a discontinued district is

Transactions of $6,000 subject to district tax in Sacramento

not listed, call 1-800-400-7115 for assistance.

County but not in the City of Galt or in the City of

The following examples are negative (-) adjustments:

Sacramento.

Transactions included in line A5 that represent the sale or

Transactions of $2,000 subject to district tax in the City of

Galt. The tax rate for the City of Galt includes district tax for

use of merchandise before the effective date of a district.

Sacramento County.

Fixed-price contracts. Deduct the sales price or lease

payments (excluding amounts collected as tax) for

Transactions of $3,000 subject to district tax in the City of

qualifying fixed-price contracts. A fixed-price contract is

Sacramento. The tax rate for the City of Sacramento includes

one entered into before the effective date of the district tax,

district tax for Sacramento County.

which (1) fixes the amount of the sales or lease price, (2)

Transactions of $4,000 subject to district tax in the City of

specifically states the amount or rate of tax based on the

Hollister, in San Benito County. These transactions would be

rate in effect when the contract was executed, and (3) does

reported on the line for the City of Hollister.

not give either party the right to terminate the contract upon

Transactions of $4,000 subject to district tax in the City of

notice. (See Regulation 1661 for information on leases of

San Juan Bautista, in San Benito County. These transactions

mobile transportation equipment.)

would be reported on the line for the City of San Juan

Merchandise used outside the district. If you paid district tax

Bautista.

on a purchase and first used the item in a different district,

you may need to enter adjustments on A6/A7. Call

A5

1-800-400-7115 for assistance.

DISTRICT TAX AREAS

ALLOCATE LINE A4 TO

Discontinued districts. If you enter nontaxable amounts on

CORRECT DISTRICT(S)

the front of your return for bad debt, tax-paid purchases

023

SACRAMENTO CO.

$6,000

resold, returned merchandise, or cash discounts, enter the

City of Galt

amounts that originally included the district tax that has

2,000

206

(Eff. 4-1-09)

been discontinued.

City of Sacramento

3,000

322

(Eff. 4-1-13)

Bad Debt Lender losses. Enter the Bad Debt Lender losses

claimed on line 10a2, located on the back of your

SAN BENITO CO.

BOE-401-A or BOE-401-GS return. Enter the net amount

City of Hollister

171

4,000

for the district where the original tax was paid.

(Eff. 4-1-08)

4,000

City of San Juan Bautista

106

Continued on page 7

Page 6

1

1 2

2 3

3 4

4 5

5 6

6 7

7