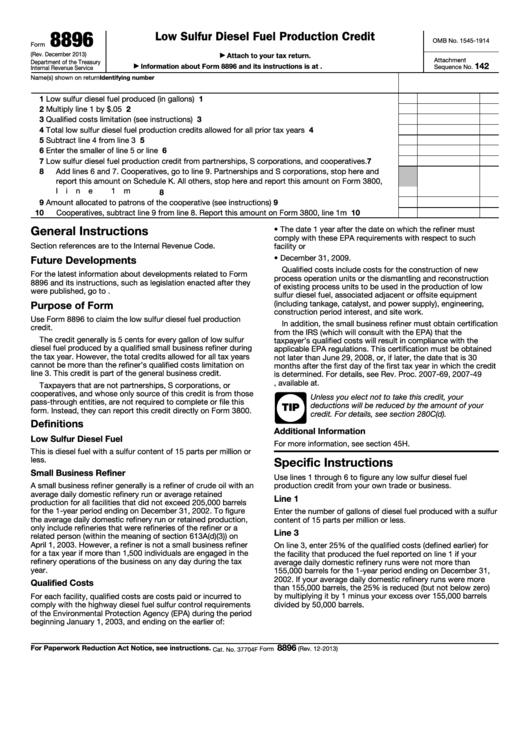

8896

Low Sulfur Diesel Fuel Production Credit

OMB No. 1545-1914

Form

(Rev. December 2013)

Attach to your tax return.

▶

Attachment

Department of the Treasury

142

Information about Form 8896 and its instructions is at

▶

Sequence No.

Internal Revenue Service

Identifying number

Name(s) shown on return

1

Low sulfur diesel fuel produced (in gallons) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Multiply line 1 by $.05 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

3

Qualified costs limitation (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Total low sulfur diesel fuel production credits allowed for all prior tax years .

.

.

.

.

.

.

4

5

Subtract line 4 from line 3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

6

Enter the smaller of line 5 or line 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Low sulfur diesel fuel production credit from partnerships, S corporations, and cooperatives

.

7

8

Add lines 6 and 7. Cooperatives, go to line 9. Partnerships and S corporations, stop here and

report this amount on Schedule K. All others, stop here and report this amount on Form 3800,

line 1m

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Amount allocated to patrons of the cooperative (see instructions)

.

.

.

.

.

.

.

.

.

.

9

10

Cooperatives, subtract line 9 from line 8. Report this amount on Form 3800, line 1m .

.

.

.

10

General Instructions

• The date 1 year after the date on which the refiner must

comply with these EPA requirements with respect to such

Section references are to the Internal Revenue Code.

facility or

• December 31, 2009.

Future Developments

Qualified costs include costs for the construction of new

For the latest information about developments related to Form

process operation units or the dismantling and reconstruction

8896 and its instructions, such as legislation enacted after they

of existing process units to be used in the production of low

were published, go to

sulfur diesel fuel, associated adjacent or offsite equipment

(including tankage, catalyst, and power supply), engineering,

Purpose of Form

construction period interest, and site work.

Use Form 8896 to claim the low sulfur diesel fuel production

In addition, the small business refiner must obtain certification

credit.

from the IRS (which will consult with the EPA) that the

The credit generally is 5 cents for every gallon of low sulfur

taxpayer’s qualified costs will result in compliance with the

diesel fuel produced by a qualified small business refiner during

applicable EPA regulations. This certification must be obtained

the tax year. However, the total credits allowed for all tax years

not later than June 29, 2008, or, if later, the date that is 30

cannot be more than the refiner’s qualified costs limitation on

months after the first day of the first tax year in which the credit

line 3. This credit is part of the general business credit.

is determined. For details, see Rev. Proc. 2007-69, 2007-49

I.R.B. 1137, available at

Taxpayers that are not partnerships, S corporations, or

cooperatives, and whose only source of this credit is from those

Unless you elect not to take this credit, your

pass-through entities, are not required to complete or file this

deductions will be reduced by the amount of your

TIP

form. Instead, they can report this credit directly on Form 3800.

credit. For details, see section 280C(d).

Definitions

Additional Information

Low Sulfur Diesel Fuel

For more information, see section 45H.

This is diesel fuel with a sulfur content of 15 parts per million or

Specific Instructions

less.

Small Business Refiner

Use lines 1 through 6 to figure any low sulfur diesel fuel

A small business refiner generally is a refiner of crude oil with an

production credit from your own trade or business.

average daily domestic refinery run or average retained

Line 1

production for all facilities that did not exceed 205,000 barrels

for the 1-year period ending on December 31, 2002. To figure

Enter the number of gallons of diesel fuel produced with a sulfur

the average daily domestic refinery run or retained production,

content of 15 parts per million or less.

only include refineries that were refineries of the refiner or a

Line 3

related person (within the meaning of section 613A(d)(3)) on

April 1, 2003. However, a refiner is not a small business refiner

On line 3, enter 25% of the qualified costs (defined earlier) for

for a tax year if more than 1,500 individuals are engaged in the

the facility that produced the fuel reported on line 1 if your

refinery operations of the business on any day during the tax

average daily domestic refinery runs were not more than

year.

155,000 barrels for the 1-year period ending on December 31,

2002. If your average daily domestic refinery runs were more

Qualified Costs

than 155,000 barrels, the 25% is reduced (but not below zero)

by multiplying it by 1 minus your excess over 155,000 barrels

For each facility, qualified costs are costs paid or incurred to

divided by 50,000 barrels.

comply with the highway diesel fuel sulfur control requirements

of the Environmental Protection Agency (EPA) during the period

beginning January 1, 2003, and ending on the earlier of:

8896

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 37704F

1

1 2

2