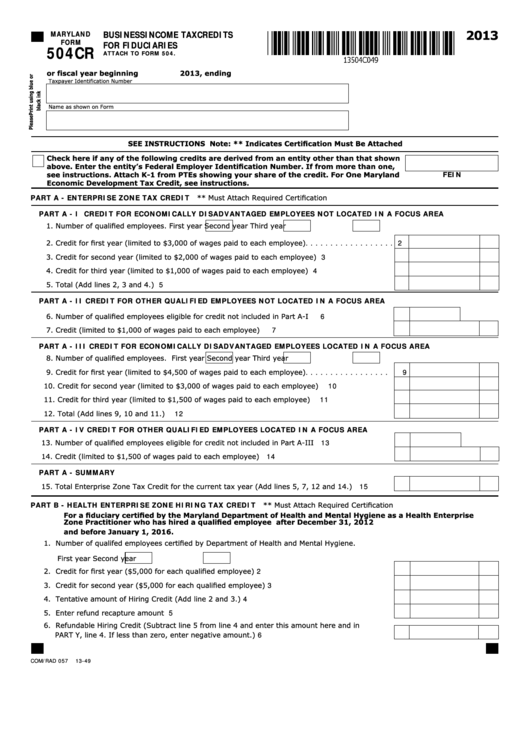

2013

MARYLAND

BUSINESS INCOME TAX CREDITS

FORM

FOR FIDUCIARIES

504CR

ATTACH TO FORM 504.

or fiscal year beginning

2013, ending

Taxpayer Identification Number

Name as shown on Form

SEE INSTRUCTIONS Note: ** Indicates Certification Must Be Attached

Check here if any of the following credits are derived from an entity other than that shown

above. Enter the entity’s Federal Employer Identification Number. If from more than one,

see instructions. Attach K-1 from PTEs showing your share of the credit. For One Maryland

FEIN

Economic Development Tax Credit, see instructions.

PART A - ENTERPRISE ZONE TAX CREDIT

** Must Attach Required Certification

PART A - I

CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES NOT LOCATED IN A FOCUS AREA

1. Number of qualified employees. First year

Second year

Third year

2. Credit for first year (limited to $3,000 of wages paid to each employee). . . . . . . . . . . . . . . . . .

2

3. Credit for second year (limited to $2,000 of wages paid to each employee) . . . . . . . . . . . . . . .

3

4. Credit for third year (limited to $1,000 of wages paid to each employee) . . . . . . . . . . . . . . . . .

4

5. Total (Add lines 2, 3 and 4.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

PART A - II

CREDIT FOR OTHER QUALIFIED EMPLOYEES NOT LOCATED IN A FOCUS AREA

6. Number of qualified employees eligible for credit not included in Part A-I . . . . . . . . . . . . . . . .

6

7. Credit (limited to $1,000 of wages paid to each employee) . . . . . . . . . . . . . . . . . . . . . . . . . .

7

PART A - III CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES LOCATED IN A FOCUS AREA

8. Number of qualified employees. First year

Second year

Third year

9. Credit for first year (limited to $4,500 of wages paid to each employee). . . . . . . . . . . . . . . . .

9

10. Credit for second year (limited to $3,000 of wages paid to each employee) . . . . . . . . . . . . . .

10

11. Credit for third year (limited to $1,500 of wages paid to each employee) . . . . . . . . . . . . . . . .

11

12. Total (Add lines 9, 10 and 11.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

PART A - IV

CREDIT FOR OTHER QUALIFIED EMPLOYEES LOCATED IN A FOCUS AREA

13. Number of qualified employees eligible for credit not included in Part A-III . . . . . . . . . . . . . . . 13

14. Credit (limited to $1,500 of wages paid to each employee) . . . . . . . . . . . . . . . . . . . . . . . . . . 14

PART A - SUMMARY

15. Total Enterprise Zone Tax Credit for the current tax year (Add lines 5, 7, 12 and 14.) . . . . . . . . 15

PART B - HEALTH ENTERPRISE ZONE HIRING TAX CREDIT

** Must Attach Required Certification

For a fiduciary certified by the Maryland Department of Health and Mental Hygiene as a Health Enterprise

Zone Practitioner who has hired a qualified employee after December 31, 2012

and before January 1, 2016.

1. Number of qualifed employees certified by Department of Health and Mental Hygiene.

First year

Second year

2. Credit for first year ($5,000 for each qualified employee) . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Credit for second year ($5,000 for each qualified employee) . . . . . . . . . . . . . . . . . . . . . . . .

3

4. Tentative amount of Hiring Credit (Add line 2 and 3.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. Enter refund recapture amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. Refundable Hiring Credit (Subtract line 5 from line 4 and enter this amount here and in

PART Y, line 4. If less than zero, enter negative amount.) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

COM/RAD 057

13-49

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23