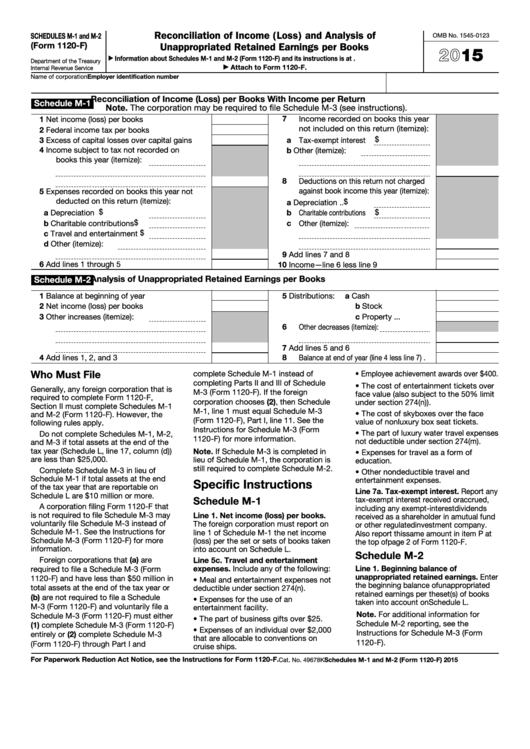

Reconciliation of Income (Loss) and Analysis of

SCHEDULES M-1 and M-2

OMB No. 1545-0123

(Form 1120-F)

Unappropriated Retained Earnings per Books

2015

Information about Schedules M-1 and M-2 (Form 1120-F) and its instructions is at

▶

Department of the Treasury

Attach to Form 1120-F.

Internal Revenue Service

▶

Name of corporation

Employer identification number

Reconciliation of Income (Loss) per Books With Income per Return

Schedule M-1

Note. The corporation may be required to file Schedule M-3 (see instructions).

7

Income recorded on books this year

1

Net income (loss) per books .

.

.

.

.

not included on this return (itemize):

2

Federal income tax per books .

.

.

.

$

3

a Tax-exempt interest

Excess of capital losses over capital gains

4

Income subject to tax not recorded on

b Other (itemize):

books this year (itemize):

8

Deductions on this return not charged

against book income this year (itemize):

5

Expenses recorded on books this year not

deducted on this return (itemize):

$

a Depreciation

.

.

$

$

a Depreciation .

.

. .

b Charitable contributions

$

b Charitable contributions

c Other (itemize):

c Travel and entertainment $

d Other (itemize):

9

Add lines 7 and 8 .

.

.

.

.

.

.

6

Add lines 1 through 5 .

.

.

.

.

.

.

10

Income—line 6 less line 9 .

.

.

.

Analysis of Unappropriated Retained Earnings per Books

Schedule M-2

1

5

a Cash

Balance at beginning of year

.

.

.

.

Distributions:

.

.

.

.

2

b Stock .

Net income (loss) per books .

.

.

.

.

.

.

.

3

Other increases (itemize):

c Property .

.

.

6

Other decreases (itemize):

7

Add lines 5 and 6 .

.

.

.

.

.

.

4

8

Add lines 1, 2, and 3 .

.

.

.

.

.

.

Balance at end of year (line 4 less line 7) .

Who Must File

complete Schedule M-1 instead of

• Employee achievement awards over $400.

completing Parts II and III of Schedule

• The cost of entertainment tickets over

Generally, any foreign corporation that is

M-3 (Form 1120-F). If the foreign

face value (also subject to the 50% limit

required to complete Form 1120-F,

corporation chooses (2), then Schedule

under section 274(n)).

Section II must complete Schedules M-1

M-1, line 1 must equal Schedule M-3

• The cost of skyboxes over the face

and M-2 (Form 1120-F). However, the

(Form 1120-F), Part I, line 11. See the

value of nonluxury box seat tickets.

following rules apply.

Instructions for Schedule M-3 (Form

• The part of luxury water travel expenses

Do not complete Schedules M-1, M-2,

1120-F) for more information.

not deductible under section 274(m).

and M-3 if total assets at the end of the

tax year (Schedule L, line 17, column (d))

Note. If Schedule M-3 is completed in

• Expenses for travel as a form of

are less than $25,000.

lieu of Schedule M-1, the corporation is

education.

still required to complete Schedule M-2.

Complete Schedule M-3 in lieu of

• Other nondeductible travel and

Schedule M-1 if total assets at the end

entertainment expenses.

Specific Instructions

of the tax year that are reportable on

Line 7a. Tax-exempt interest. Report any

Schedule L are $10 million or more.

Schedule M-1

tax-exempt interest received or accrued,

A corporation filing Form 1120-F that

including any exempt-interest dividends

is not required to file Schedule M-3 may

Line 1. Net income (loss) per books.

received as a shareholder in a mutual fund

voluntarily file Schedule M-3 instead of

The foreign corporation must report on

or other regulated investment company.

Schedule M-1. See the Instructions for

line 1 of Schedule M-1 the net income

Also report this same amount in item P at

Schedule M-3 (Form 1120-F) for more

(loss) per the set or sets of books taken

the top of page 2 of Form 1120-F.

information.

into account on Schedule L.

Schedule M-2

Foreign corporations that (a) are

Line 5c. Travel and entertainment

Line 1. Beginning balance of

expenses. Include any of the following:

required to file a Schedule M-3 (Form

unappropriated retained earnings. Enter

1120-F) and have less than $50 million in

• Meal and entertainment expenses not

the beginning balance of unappropriated

total assets at the end of the tax year or

deductible under section 274(n).

retained earnings per the set(s) of books

(b) are not required to file a Schedule

• Expenses for the use of an

taken into account on Schedule L.

M-3 (Form 1120-F) and voluntarily file a

entertainment facility.

Note. For additional information for

Schedule M-3 (Form 1120-F) must either

• The part of business gifts over $25.

Schedule M-2 reporting, see the

(1) complete Schedule M-3 (Form 1120-F)

• Expenses of an individual over $2,000

Instructions for Schedule M-3 (Form

entirely or (2) complete Schedule M-3

that are allocable to conventions on

1120-F).

(Form 1120-F) through Part I and

cruise ships.

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-F.

Schedules M-1 and M-2 (Form 1120-F) 2015

Cat. No. 49678K

1

1