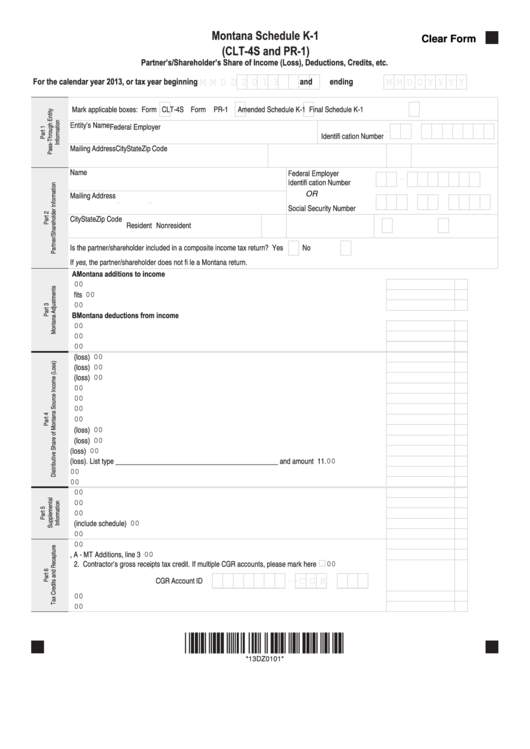

Montana Schedule K-1

Clear Form

(CLT-4S and PR-1)

Partner’s/Shareholder’s Share of Income (Loss), Deductions, Credits, etc.

For the calendar year 2013, or tax year beginning

and ending

M M D D 2 0 1 3

M M D D Y Y Y Y

Mark applicable boxes:

Form CLT-4S

Form PR-1

Amended Schedule K-1

Final Schedule K-1

Entity’s Name

Federal Employer

-

Identifi cation Number

Mailing Address

City

State

Zip Code

Name

Federal Employer

-

Identifi cation Number

OR

Mailing Address

-

-

Social Security Number

City

State

Zip Code

Resident

Nonresident

Is the partner/shareholder included in a composite income tax return?

Yes

No

If yes, the partner/shareholder does not fi le a Montana return.

A Montana additions to income

1. Federal tax-exempt interest and dividends ............................................................................................... A1.

00

2. Taxes based on income or profi ts ............................................................................................................. A2.

00

3. Other additions. List type __________________________________________________ and amount A3.

00

B Montana deductions from income

1. Interest on US government obligations .................................................................................................... B1.

00

2. Deduction for purchasing recycled material ............................................................................................. B2.

00

3. Other deductions. List type ________________________________________________ and amount B3.

00

1. Ordinary business income (loss) .................................................................................................................1.

00

2. Net rental real estate income (loss) .............................................................................................................2.

00

3. Other net rental income (loss) .....................................................................................................................3.

00

4. Guaranteed payments .................................................................................................................................4.

00

5. Interest income ............................................................................................................................................5.

00

6. Ordinary dividends .......................................................................................................................................6.

00

7. Royalties ......................................................................................................................................................7.

00

8. Net short-term capital gain (loss) .................................................................................................................8.

00

9. Net long-term capital gain (loss) ..................................................................................................................9.

00

10. Net section 1231 gain (loss) ......................................................................................................................10.

00

11. Other income (loss). List type ______________________________________________ and amount 11.

00

12. Section 179 expense deduction apportionable and/or allocable to Montana ............................................12.

00

13. Other expense deductions apportionable and/or allocable to Montana ....................................................13.

00

1. Montana composite income tax paid on behalf of partner/shareholder .......................................................1.

00

2. Montana income tax withheld on behalf of partner/shareholder ..................................................................2.

00

3. Montana mineral royalty tax withheld ..........................................................................................................3.

00

4. Separately stated allocable nonbusiness items (include schedule) ............................................................4.

00

5. Other information. List type _________________________________________________ and amount 5.

00

1. Insure Montana small business health insurance credit. Business FEIN _________________________ 1.

00

1a. Insure Montana small business health insurance premiums from Part 3, A - MT Additions, line 3 ...........1a.

00

2. Contractor’s gross receipts tax credit. If multiple CGR accounts, please mark here

.............................2.

00

CGR Account ID

-

- C G R

3. Health insurance for uninsured Montanans credit .......................................................................................3.

00

4. Other credit/recapture information. List type ____________________________________ and amount 4.

00

*13DZ0101*

*13DZ0101*

1

1 2

2