Form It-2104-Sny - Certificate Of Exemption From Withholding For Start-Up Ny Program - 2015

ADVERTISEMENT

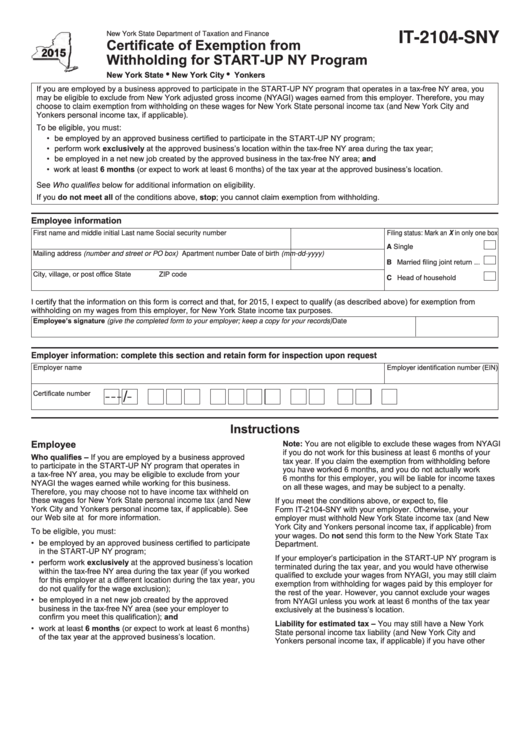

New York State Department of Taxation and Finance

IT-2104-SNY

Certificate of Exemption from

Withholding for START-UP NY Program

•

•

New York State

New York City

Yonkers

If you are employed by a business approved to participate in the START-UP NY program that operates in a tax-free NY area, you

may be eligible to exclude from New York adjusted gross income (NYAGI) wages earned from this employer. Therefore, you may

choose to claim exemption from withholding on these wages for New York State personal income tax (and New York City and

Yonkers personal income tax, if applicable).

To be eligible, you must:

• be employed by an approved business certified to participate in the START-UP NY program;

• perform work exclusively at the approved business’s location within the tax-free NY area during the tax year;

• be employed in a net new job created by the approved business in the tax-free NY area; and

• work at least 6 months (or expect to work at least 6 months) of the tax year at the approved business’s location.

See Who qualifies below for additional information on eligibility.

If you do not meet all of the conditions above, stop; you cannot claim exemption from withholding.

Employee information

First name and middle initial

Last name

Social security number

Filing status: Mark an X in only one box

A Single . ...............................

Mailing address (number and street or PO box)

Apartment number

Date of birth (mm-dd-yyyy)

B Married filing joint return ...

City, village, or post office

State

ZIP code

C Head of household . ...........

I certify that the information on this form is correct and that, for 2015, I expect to qualify (as described above) for exemption from

withholding on my wages from this employer, for New York State income tax purposes.

Employee’s signature (give the completed form to your employer; keep a copy for your records)

Date

Employer information: complete this section and retain form for inspection upon request

Employer identification number (EIN)

Employer name

Certificate number

/

–

–

–

–

Instructions

Employee

Note: You are not eligible to exclude these wages from NYAGI

if you do not work for this business at least 6 months of your

Who qualifies – If you are employed by a business approved

tax year. If you claim the exemption from withholding before

to participate in the START-UP NY program that operates in

you have worked 6 months, and you do not actually work

a tax-free NY area, you may be eligible to exclude from your

6 months for this employer, you will be liable for income taxes

NYAGI the wages earned while working for this business.

on all these wages, and may be subject to a penalty.

Therefore, you may choose not to have income tax withheld on

If you meet the conditions above, or expect to, file

these wages for New York State personal income tax (and New

York City and Yonkers personal income tax, if applicable). See

Form IT-2104-SNY with your employer. Otherwise, your

our Web site at for more information.

employer must withhold New York State income tax (and New

York City and Yonkers personal income tax, if applicable) from

To be eligible, you must:

your wages. Do not send this form to the New York State Tax

• be employed by an approved business certified to participate

Department.

in the START-UP NY program;

If your employer’s participation in the START-UP NY program is

• perform work exclusively at the approved business’s location

terminated during the tax year, and you would have otherwise

within the tax-free NY area during the tax year (if you worked

qualified to exclude your wages from NYAGI, you may still claim

for this employer at a different location during the tax year, you

exemption from withholding for wages paid by this employer for

do not qualify for the wage exclusion);

the rest of the year. However, you cannot exclude your wages

• be employed in a net new job created by the approved

from NYAGI unless you work at least 6 months of the tax year

business in the tax-free NY area (see your employer to

exclusively at the business’s location.

confirm you meet this qualification); and

Liability for estimated tax – You may still have a New York

• work at least 6 months (or expect to work at least 6 months)

State personal income tax liability (and New York City and

of the tax year at the approved business’s location.

Yonkers personal income tax, if applicable) if you have other

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2