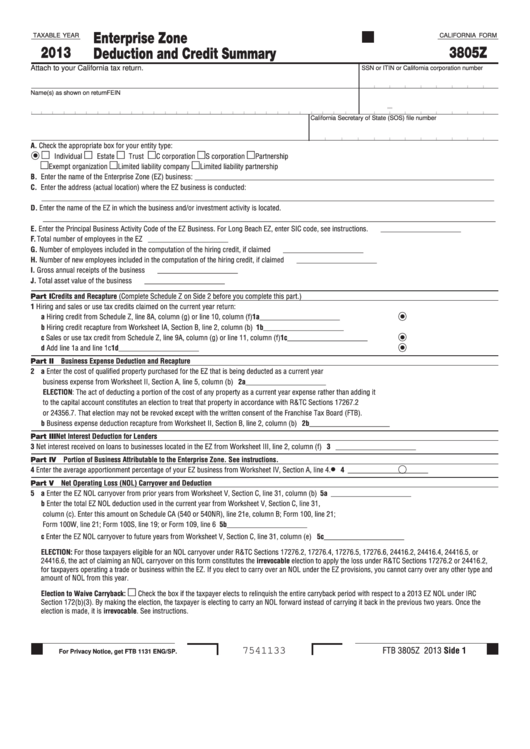

Enterprise Zone

TAXABLE YEAR

CALIFORNIA FORM

2013

3805Z

Deduction and Credit Summary

Attach to your California tax return.

SSN or ITIN or California corporation number

Name(s) as shown on return

FEIN

California Secretary of State (SOS) file number

A. Check the appropriate box for your entity type:

Individual

Estate

Trust

C corporation

S corporation

Partnership

Exempt organization

Limited liability company

Limited liability partnership

B. Enter the name of the Enterprise Zone (EZ) business: __________________________________________________________________________________

C. Enter the address (actual location) where the EZ business is conducted:

____________________________________________________________________________________________________________________________

D. Enter the name of the EZ in which the business and/or investment activity is located .

____________________________________________________________________________________________________________________________

E. Enter the Principal Business Activity Code of the EZ Business . For Long Beach EZ, enter SIC code, see instructions . . . . . . . . .

______________________

F. Total number of employees in the EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

G. Number of employees included in the computation of the hiring credit, if claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

H. Number of new employees included in the computation of the hiring credit, if claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

I. Gross annual receipts of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

J. Total asset value of the business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________

Part I Credits and Recapture (Complete Schedule Z on Side 2 before you complete this part .)

1 Hiring and sales or use tax credits claimed on the current year return:

a Hiring credit from Schedule Z, line 8A, column (g) or line 10, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a______________________

b Hiring credit recapture from Worksheet IA, Section B, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b______________________

c Sales or use tax credit from Schedule Z, line 9A, column (g) or line 11, column (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c______________________

d Add line 1a and line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1d______________________

Part II Business Expense Deduction and Recapture

2 a Enter the cost of qualified property purchased for the EZ that is being deducted as a current year

business expense from Worksheet II, Section A, line 5, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a______________________

ELECTION: The act of deducting a portion of the cost of any property as a current year expense rather than adding it

to the capital account constitutes an election to treat that property in accordance with R&TC Sections 17267 .2

or 24356 .7 . That election may not be revoked except with the written consent of the Franchise Tax Board (FTB) .

b Business expense deduction recapture from Worksheet II, Section B, line 2, column (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b______________________

Part III Net Interest Deduction for Lenders

3 Net interest received on loans to businesses located in the EZ from Worksheet III, line 2, column (f) . . . . . . . . . . . . . . . . . . . . 3 ______________________

Part IV Portion of Business Attributable to the Enterprise Zone. See instructions.

4 Enter the average apportionment percentage of your EZ business from Worksheet IV, Section A, line 4 . . . . . . . . . . . . . . . . .

4 ______________________

Part V Net Operating Loss (NOL) Carryover and Deduction

5 a Enter the EZ NOL carryover from prior years from Worksheet V, Section C, line 31, column (b) . . . . . . . . . . . . . . . . . . . . . . 5a ______________________

b Enter the total EZ NOL deduction used in the current year from Worksheet V, Section C, line 31,

column (c) . Enter this amount on Schedule CA (540 or 540NR), line 21e, column B; Form 100, line 21;

Form 100W, line 21; Form 100S, line 19; or Form 109, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b______________________

c Enter the EZ NOL carryover to future years from Worksheet V, Section C, line 31, column (e) . . . . . . . . . . . . . . . . . . . . . . .

5c______________________

ELECTION: For those taxpayers eligible for an NOL carryover under R&TC Sections 17276 .2, 17276 .4, 17276 .5, 17276 .6, 24416 .2, 24416 .4, 24416 .5, or

24416 .6, the act of claiming an NOL carryover on this form constitutes the irrevocable election to apply the loss under R&TC Sections 17276 .2 or 24416 .2,

for taxpayers operating a trade or business within the EZ . If you elect to carry over an NOL under the EZ provisions, you cannot carry over any other type and

amount of NOL from this year .

Election to Waive Carryback:

Check the box if the taxpayer elects to relinquish the entire carryback period with respect to a 2013 EZ NOL under IRC

Section 172(b)(3) . By making the election, the taxpayer is electing to carry an NOL forward instead of carrying it back in the previous two years . Once the

election is made, it is irrevocable . See instructions .

FTB 3805Z 2013 Side 1

7541133

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2