Form 100s - California S Corporation Franchise Or Income Tax Return - 2015

ADVERTISEMENT

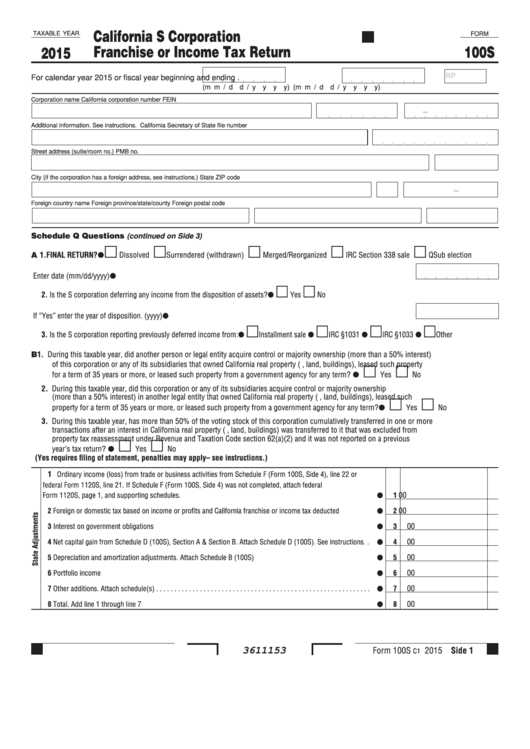

California S Corporation

TAXABLE YEAR

FORM

Franchise or Income Tax Return

100S

2015

RP

For calendar year 2015 or fiscal year beginning

and ending

.

(m m / d d / y y y y)

(m m / d d / y y y y)

Corporation name

California corporation number

FEIN

Additional information. See instructions.

California Secretary of State file number

Street address (suite/room no.)

PMB no.

City (if the corporation has a foreign address, see instructions.)

State

ZIP code

Foreign country name

Foreign province/state/county

Foreign postal code

Schedule Q Questions

(continued on Side 3)

A 1. FINAL RETURN?

Surrendered (withdrawn)

Dissolved

Merged/Reorganized

IRC Section 338 sale

QSub election

Enter date (mm/dd/yyyy) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Is the S corporation deferring any income from the disposition of assets? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes” enter the year of disposition . (yyyy) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Is the S corporation reporting previously deferred income from: . . . .

Installment sale

IRC §1031

IRC §1033

Other

B 1. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest)

of this corporation or any of its subsidiaries that owned California real property (i .e ., land, buildings), leased such property

for a term of 35 years or more, or leased such property from a government agency for any term? . . . . . . . . . . . . . . . . .

Yes

No

2. During this taxable year, did this corporation or any of its subsidiaries acquire control or majority ownership

(more than a 50% interest) in another legal entity that owned California real property (i .e ., land, buildings), leased such

property for a term of 35 years or more, or leased such property from a government agency for any term? . . . . . . . . . . .

Yes

No

3. During this taxable year, has more than 50% of the voting stock of this corporation cumulatively transferred in one or more

transactions after an interest in California real property (i .e ., land, buildings) was transferred to it that was excluded from

property tax reassessment under Revenue and Taxation Code section 62(a)(2) and it was not reported on a previous

year’s tax return? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(Yes requires filing of statement, penalties may apply– see instructions.)

1

Ordinary income (loss) from trade or business activities from Schedule F (Form 100S, Side 4), line 22 or

federal Form 1120S, line 21 . If Schedule F (Form 100S, Side 4) was not completed, attach federal

00

Form 1120S, page 1, and supporting schedules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Foreign or domestic tax based on income or profits and California franchise or income tax deducted . . . . . . . .

2

00

3 Interest on government obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Net capital gain from Schedule D (100S), Section A & Section B . Attach Schedule D (100S) . See instructions . .

4

00

5 Depreciation and amortization adjustments . Attach Schedule B (100S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Portfolio income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Other additions . Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Total . Add line 1 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Form 100S

2015 Side 1

3611153

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6