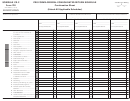

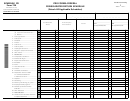

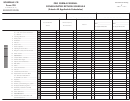

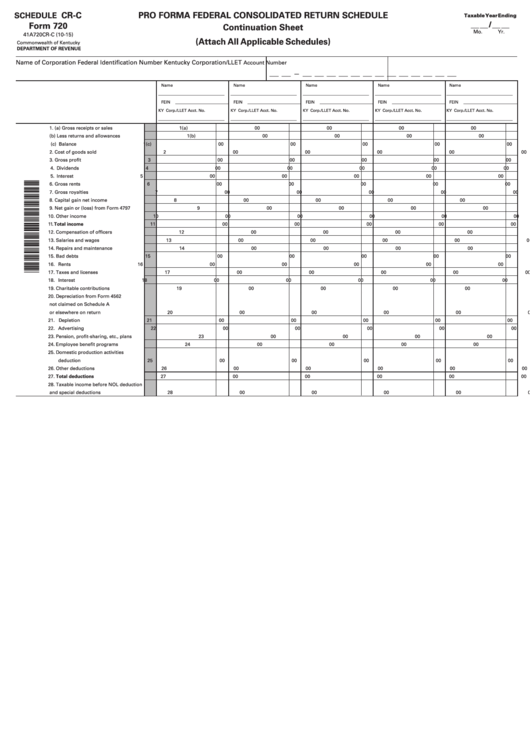

CR-C

PRO FORMA FEDERAL CONSOLIDATED RETURN SCHEDULE

SCHEDULE

Taxable Year Ending

__ __ / __ __

Form 720

Continuation Sheet

Mo.

Yr.

41A720CR-C (10-15)

(Attach All Applicable Schedules)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET

Account Number

___ ___ — ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___

Name

Name

Name

Name

Name

________________________________

________________________________

________________________________

________________________________

________________________________

FEIN __________________________

FEIN __________________________

FEIN __________________________

FEIN __________________________

FEIN __________________________

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

________________________________

________________________________

________________________________

________________________________

________________________________

1. (a) Gross receipts or sales ................... 1(a)

00

00

00

00

00

(b) Less returns and allowances .......... 1(b)

00

00

00

00

00

(c) Balance ............................................ 1(c)

00

00

00

00

00

2. Cost of goods sold ................................

2

00

00

00

00

00

3. Gross profit ............................................

3

00

00

00

00

00

4. Dividends ...............................................

4

00

00

00

00

00

5. Interest ...................................................

5

00

00

00

00

00

6. Gross rents ............................................

6

00

00

00

00

00

7. Gross royalties ......................................

7

00

00

00

00

00

8. Capital gain net income ........................

8

00

00

00

00

00

9. Net gain or (loss) from Form 4797 .......

9

00

00

00

00

00

10. Other income .........................................

10

00

00

00

00

00

11. Total income ..........................................

11

00

00

00

00

00

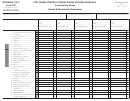

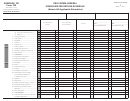

12. Compensation of officers .....................

12

00

00

00

00

00

13. Salaries and wages ...............................

13

00

00

00

00

00

14. Repairs and maintenance .....................

14

00

00

00

00

00

15. Bad debts ...............................................

15

00

00

00

00

00

16. Rents ......................................................

16

00

00

00

00

00

17. Taxes and licenses ................................

17

00

00

00

00

00

18. Interest ...................................................

18

00

00

00

00

00

19. Charitable contributions .......................

19

00

00

00

00

00

20. Depreciation from Form 4562

not claimed on Schedule A

or elsewhere on return .........................

20

00

00

00

00

00

21. Depletion ...............................................

21

00

00

00

00

00

22. Advertising ............................................

22

00

00

00

00

00

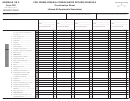

23. Pension, profit-sharing, etc., plans ......

23

00

00

00

00

00

24. Employee benefit programs ................

24

00

00

00

00

00

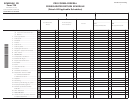

25. Domestic production activities

deduction ...............................................

25

00

00

00

00

00

26. Other deductions ..................................

26

00

00

00

00

00

27. Total deductions ....................................

27

00

00

00

00

00

28. Taxable income before NOL deduction

and special deductions .........................

28

00

00

00

00

00

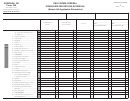

1

1