Arizona Form 320 - Credit For Employment Of Tanf Recipients - 2014

ADVERTISEMENT

Arizona Form

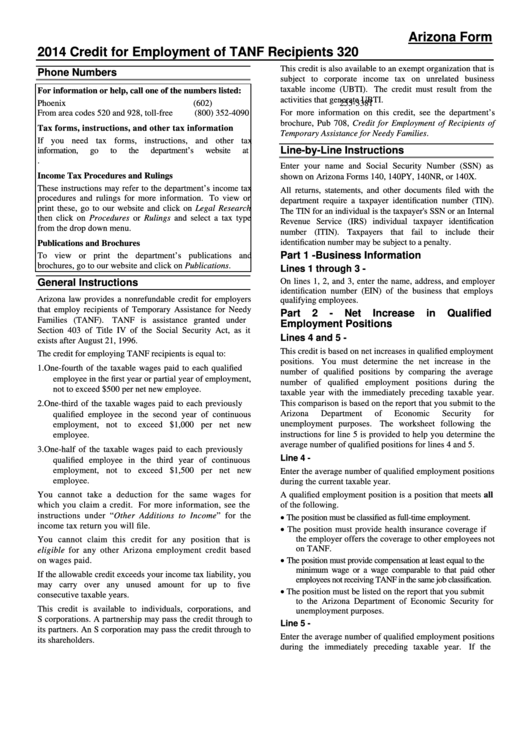

2014 Credit for Employment of TANF Recipients

320

This credit is also available to an exempt organization that is

Phone Numbers

subject to corporate income tax on unrelated business

taxable income (UBTI). The credit must result from the

For information or help, call one of the numbers listed:

activities that generate UBTI.

Phoenix

(602) 255-3381

For more information on this credit, see the department’s

From area codes 520 and 928, toll-free

(800) 352-4090

brochure, Pub 708, Credit for Employment of Recipients of

Tax forms, instructions, and other tax information

Temporary Assistance for Needy Families.

If you need tax forms, instructions, and other tax

Line-by-Line Instructions

information,

go

to

the

department’s

website

at

Enter your name and Social Security Number (SSN) as

Income Tax Procedures and Rulings

shown on Arizona Forms 140, 140PY, 140NR, or 140X.

These instructions may refer to the department’s income tax

All returns, statements, and other documents filed with the

procedures and rulings for more information. To view or

department require a taxpayer identification number (TIN).

print these, go to our website and click on Legal Research

The TIN for an individual is the taxpayer's SSN or an Internal

then click on Procedures or Rulings and select a tax type

Revenue Service (IRS) individual taxpayer identification

from the drop down menu.

number (ITIN). Taxpayers that fail to include their

identification number may be subject to a penalty.

Publications and Brochures

Part 1 - Business Information

To view or print the department’s publications and

brochures, go to our website and click on Publications.

Lines 1 through 3 -

On lines 1, 2, and 3, enter the name, address, and employer

General Instructions

identification number (EIN) of the business that employs

Arizona law provides a nonrefundable credit for employers

qualifying employees.

that employ recipients of Temporary Assistance for Needy

Part

2

-

Net

Increase

in

Qualified

Families (TANF).

TANF is assistance granted under

Employment Positions

Section 403 of Title IV of the Social Security Act, as it

Lines 4 and 5 -

exists after August 21, 1996.

This credit is based on net increases in qualified employment

The credit for employing TANF recipients is equal to:

positions.

You must determine the net increase in the

1. One-fourth of the taxable wages paid to each qualified

number of qualified positions by comparing the average

employee in the first year or partial year of employment,

number of qualified employment positions during the

not to exceed $500 per net new employee.

taxable year with the immediately preceding taxable year.

This comparison is based on the report that you submit to the

2. One-third of the taxable wages paid to each previously

Arizona

Department

of

Economic

Security

for

qualified employee in the second year of continuous

unemployment purposes.

The worksheet following the

employment, not to exceed $1,000 per net new

instructions for line 5 is provided to help you determine the

employee.

average number of qualified positions for lines 4 and 5.

3. One-half of the taxable wages paid to each previously

Line 4 -

qualified employee in the third year of continuous

employment, not to exceed $1,500 per net new

Enter the average number of qualified employment positions

employee.

during the current taxable year.

You cannot take a deduction for the same wages for

A qualified employment position is a position that meets all

which you claim a credit. For more information, see the

of the following.

instructions under “Other Additions to Income” for the

The position must be classified as full-time employment.

income tax return you will file.

The position must provide health insurance coverage if

the employer offers the coverage to other employees not

You cannot claim this credit for any position that is

on TANF.

eligible for any other Arizona employment credit based

on wages paid.

The position must provide compensation at least equal to the

minimum wage or a wage comparable to that paid other

If the allowable credit exceeds your income tax liability, you

employees not receiving TANF in the same job classification.

may carry over any unused amount for up to five

The position must be listed on the report that you submit

consecutive taxable years.

to the Arizona Department of Economic Security for

This credit is available to individuals, corporations, and

unemployment purposes.

S corporations. A partnership may pass the credit through to

Line 5 -

its partners. An S corporation may pass the credit through to

Enter the average number of qualified employment positions

its shareholders.

during the immediately preceding taxable year.

If the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4