Form 32-041 - Corporation Tax Credit For Third Party Sales Tax Application

ADVERTISEMENT

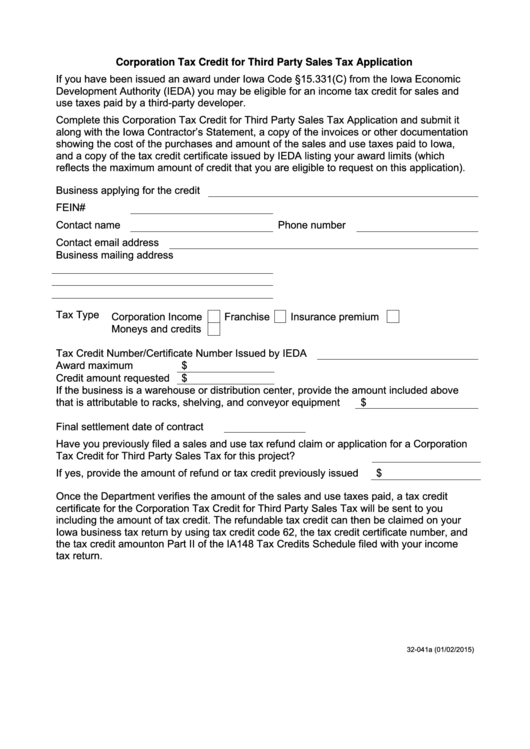

Corporation Tax Credit for Third Party Sales Tax Application

If you have been issued an award under Iowa Code §15.331(C) from the Iowa Economic

Development Authority (IEDA) you may be eligible for an income tax credit for sales and

use taxes paid by a third-party developer.

Complete this Corporation Tax Credit for Third Party Sales Tax Application and submit it

along with the Iowa Contractor’s Statement, a copy of the invoices or other documentation

showing the cost of the purchases and amount of the sales and use taxes paid to Iowa,

and a copy of the tax credit certificate issued by IEDA listing your award limits (which

reflects the maximum amount of credit that you are eligible to request on this application).

Business applying for the credit

FEIN#

Contact name

Phone number

Contact email address

Business mailing address

Tax Type

Corporation Income

Franchise

Insurance premium

Moneys and credits

Tax Credit Number/Certificate Number Issued by IEDA

Award maximum

$

Credit amount requested

$

If the business is a warehouse or distribution center, provide the amount included above

that is attributable to racks, shelving, and conveyor equipment

$

Final settlement date of contract

Have you previously filed a sales and use tax refund claim or application for a Corporation

Tax Credit for Third Party Sales Tax for this project?

If yes, provide the amount of refund or tax credit previously issued

$

Once the Department verifies the amount of the sales and use taxes paid, a tax credit

certificate for the Corporation Tax Credit for Third Party Sales Tax will be sent to you

including the amount of tax credit. The refundable tax credit can then be claimed on your

Iowa business tax return by using tax credit code 62, the tax credit certificate number, and

the tax credit amount on Part II of the IA148 Tax Credits Schedule filed with your income

tax return.

32-041a (01/02/2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2