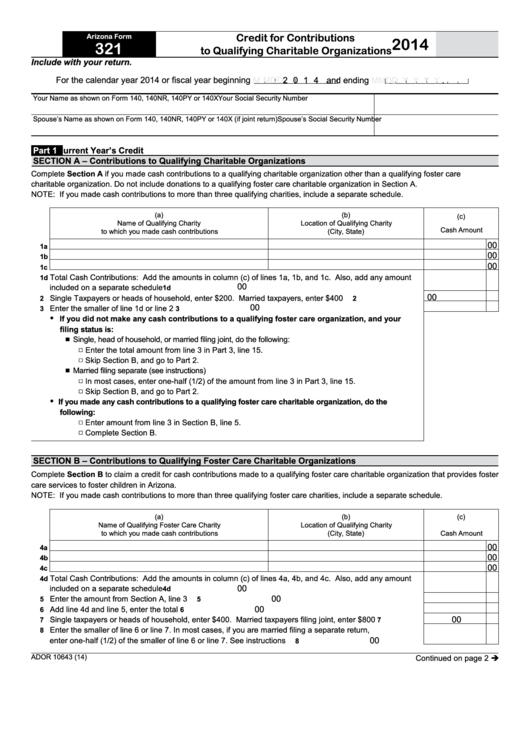

Credit for Contributions

Arizona Form

2014

321

to Qualifying Charitable Organizations

Include with your return.

For the calendar year 2014 or fiscal year beginning

M M D D

2 0 1 4 and ending

M M D D Y Y Y Y

.

Your Name as shown on Form 140, 140NR, 140PY or 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140NR, 140PY or 140X (if joint return)

Spouse’s Social Security Number

Part 1

Current Year’s Credit

SECTION A – Contributions to Qualifying Charitable Organizations

Complete Section A if you made cash contributions to a qualifying charitable organization other than a qualifying foster care

charitable organization. Do not include donations to a qualifying foster care charitable organization in Section A.

NOTE: If you made cash contributions to more than three qualifying charities, include a separate schedule.

(a)

(b)

(c)

Name of Qualifying Charity

Location of Qualifying Charity

Cash Amount

to which you made cash contributions

(City, State)

00

1a

00

1b

00

1c

Total Cash Contributions: Add the amounts in column (c) of lines 1a, 1b, and 1c. Also, add any amount

1d

00

included on a separate schedule ................................................................................................................

1d

00

Single Taxpayers or heads of household, enter $200. Married taxpayers, enter $400 ............................

2

2

00

Enter the smaller of line 1d or line 2 ..........................................................................................................

3

3

If you did not make any cash contributions to a qualifying foster care organization, and your

filing status is:

■ Single, head of household, or married filing joint, do the following:

□ Enter the total amount from line 3 in Part 3, line 15.

□ Skip Section B, and go to Part 2.

■ Married filing separate (see instructions)

□ In most cases, enter one-half (1/2) of the amount from line 3 in Part 3, line 15.

□ Skip Section B, and go to Part 2.

If you made any cash contributions to a qualifying foster care charitable organization, do the

following:

□ Enter amount from line 3 in Section B, line 5.

□ Complete Section B.

SECTION B – Contributions to Qualifying Foster Care Charitable Organizations

Complete Section B to claim a credit for cash contributions made to a qualifying foster care charitable organization that provides foster

care services to foster children in Arizona.

NOTE: If you made cash contributions to more than three qualifying foster care charities, include a separate schedule.

(a)

(b)

(c)

Name of Qualifying Foster Care Charity

Location of Qualifying Charity

to which you made cash contributions

(City, State)

Cash Amount

00

4a

00

4b

00

4c

Total Cash Contributions: Add the amounts in column (c) of lines 4a, 4b, and 4c. Also, add any amount

4d

00

included on a separate schedule ................................................................................................................

4d

00

Enter the amount from Section A, line 3 ....................................................................................................

5

5

00

Add line 4d and line 5, enter the total ........................................................................................................

6

6

00

Single taxpayers or heads of household, enter $400. Married taxpayers filing joint, enter $800 .............

7

7

Enter the smaller of line 6 or line 7. In most cases, if you are married filing a separate return,

8

00

enter one-half (1/2) of the smaller of line 6 or line 7. See instructions ......................................................

8

ADOR 10643 (14)

Continued on page 2

1

1 2

2