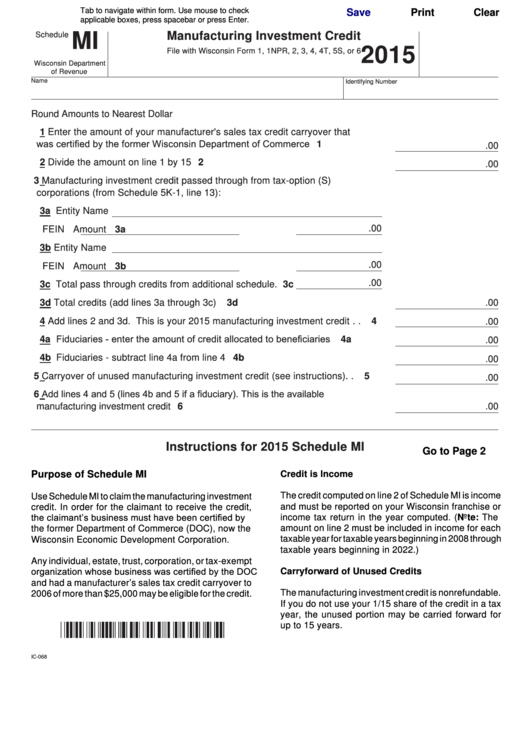

Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

MI

Manufacturing Investment Credit

Schedule

2015

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6

Wisconsin Department

of Revenue

Name

Identifying Number

Round Amounts to Nearest Dollar

1

Enter the amount of your manufacturer's sales tax credit carryover that

was certified by the former Wisconsin Department of Commerce . . . . . . . . 1

.00

2

Divide the amount on line 1 by 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

3

Manufacturing investment credit passed through from tax-option (S)

corporations (from Schedule 5K-1, line 13):

3a Entity Name

.00

FEIN

Amount 3a

3b Entity Name

.00

FEIN

Amount 3b

.00

3c Total pass through credits from additional schedule. 3c

3d Total credits (add lines 3a through 3c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3d

.00

4

Add lines 2 and 3d. This is your 2015 manufacturing investment credit . . . 4

.00

4a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . 4a

.00

4b Fiduciaries - subtract line 4a from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

.00

5

Carryover of unused manufacturing investment credit (see instructions) . . 5

.00

Add lines 4 and 5 (lines 4b and 5 if a fiduciary). This is the available

6

manufacturing investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.00

Instructions for 2015 Schedule MI

Go to Page 2

Purpose of Schedule MI

Credit is Income

The credit computed on line 2 of Schedule MI is income

Use Schedule MI to claim the manufacturing investment

and must be reported on your Wisconsin franchise or

credit. In order for the claimant to receive the credit,

the claimant’s business must have been certified by

income tax return in the year computed. (Note: The

amount on line 2 must be included in income for each

the former Department of Commerce (DOC), now the

taxable year for taxable years beginning in 2008 through

Wisconsin Economic Development Corporation.

taxable years beginning in 2022.)

Any individual, estate, trust, corporation, or tax-exempt

organization whose business was certified by the DOC

Carryforward of Unused Credits

and had a manufacturer’s sales tax credit carryover to

The manufacturing investment credit is nonrefundable.

2006 of more than $25,000 may be eligible for the credit.

If you do not use your 1/15 share of the credit in a tax

year, the unused portion may be carried forward for

up to 15 years.

IC-068

1

1 2

2