Instructions For Arizona Form 315 - Pollution Control Credit - 2014

ADVERTISEMENT

Arizona Form

2014 Pollution Control Credit

315

All returns, statements, and other documents filed with the

Obtain additional information or assistance by calling one of

department require a taxpayer identification number (TIN).

the numbers listed below:

The TIN for a corporation, an exempt organization with UBTI,

Phoenix

(602) 255-3381

an S corporation, or a partnership is the taxpayer's employer

From area codes 520 and 928, toll-free

(800) 352-4090

identification number. The TIN for an individual is the

Obtain tax rulings, tax procedures, tax forms and instructions,

taxpayer's social security number or an Internal Revenue

and other tax information by accessing the department's

Service individual taxpayer identification number. Taxpayers

website at

that fail to include their TIN may be subject to a penalty.

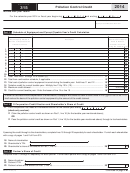

Part 1 - Schedule of Equipment and Current

General Instructions

Taxable Year's Credit Calculation

Arizona Revised Statutes §§ 43-1081 and 43-1170 provide

Lines 1 through 10 -

nonrefundable individual and corporate income tax credits for

Column (a): Enter the date that the property was placed in

expenses incurred during the taxable year to purchase real or

service or the date it is expected to be placed in service in

personal property that is used within Arizona in the taxpayer's

Arizona.

trade or business to control or prevent pollution. The amount

of the credit is equal to 10% of the purchase price, limited to

Column (b): Enter a brief description of the property used in

a maximum credit of $500,000 in a taxable year.

the taxpayer's business in Arizona to control or prevent pollution.

Co-owners of a business, including partners in a partnership

Column (c): Enter the cost of that portion of the property

and shareholders of an S corporation, may each claim only

directly used to reduce pollution that was incurred during this

the pro rata share of the credit allowed based on the

taxable year.

ownership interest. The total of the credits allowed all such

If there are more than 10 items of qualifying property, complete

owners may not exceed the amount that would have been

additional schedules. Include the completed schedules with

allowed for a sole owner of the business.

Form 315.

The credit is available to an exempt organization that is

Line 11 -

subject to corporate income tax on unrelated business taxable

income (UBTI). The credit must result from the activities that

Add lines 1 through 10 in column (c) and enter the total.

generate UBTI.

Line 12 -

Qualifying property includes a structure, building, installation,

Enter the aggregate column (c) totals from additional schedules.

excavation, machine, equipment, and any attachment to, or

addition to, or reconstruction, replacement, or improvement of

Line 13 -

that property. Property eligible for the tax credit includes only

Add lines 11 and 12 and enter the total. This is the total cost

that portion of the property directly used, constructed, or

incurred during this taxable year of all items of property for

installed in Arizona to prevent, monitor, or reduce air, water, or

which the taxpayer is claiming the credit.

land pollution that results from the taxpayer’s direct operating

activities in conducting a trade or business in this state. The

Line 14 -

property must meet or exceed rules or regulations adopted for

Multiply line 13 by 10% (.10) and enter the result.

this purpose by the United States Environmental Protection

Line 16 -

Agency, the Arizona Department of Environmental Quality, or a

political subdivision of Arizona.

Enter the lesser of line 14 or line 15. This is the allowable

Amounts that qualify for the credit must be includible in

credit for the current taxable year.

the taxpayer's adjusted basis for the property. The adjusted

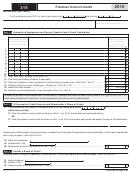

Part 2 - S Corporation Credit Election and

basis of any property for which the taxpayer has claimed a

Shareholder's Share of Credit

credit must be reduced by the amount of credit claimed for

that property.

Line 17 - S Corporation Credit Election

If the allowable tax credit exceeds the taxes otherwise due or,

S corporations must complete line 17. The S corporation must

if there are no taxes due, the amount of the credit not used to

make an irrevocable election to either claim the credit or pass

offset taxes may be carried forward for not more than five

the credit through to its shareholders. The election statement

taxable years as a credit against subsequent years' income tax

must be signed by one of the officers of the S corporation

liabilities.

who is also a signatory to Arizona Form 120S.

Lines 18 through 20 -

Specific Instructions

If the S corporation elects to pass the credit through to its

Complete the name and taxpayer identification number

shareholders, it must also complete lines 18 through 20.

section at the top of the form. Indicate the period covered by

The S corporation must complete Part 1. Then, complete

the taxable year. Include the completed form with the tax

Part 2, lines 18 through 20, separately for each shareholder.

return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2